Question: Trident Limited is considering replacing an old machine. The new machine is expected improve output which would increase additional net cash flows of $100, 000

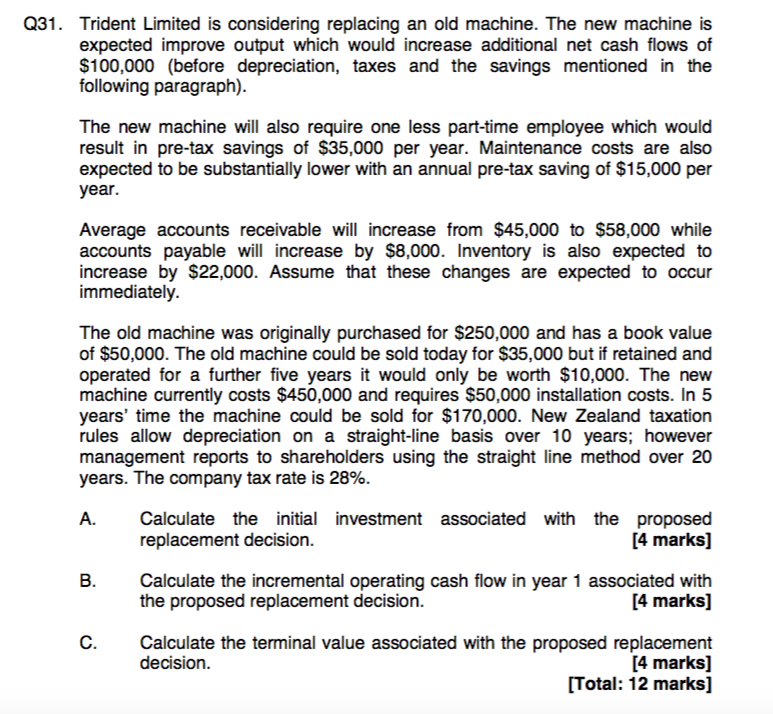

Trident Limited is considering replacing an old machine. The new machine is expected improve output which would increase additional net cash flows of $100, 000 (before depreciation, taxes and the savings mentioned in the following paragraph). The new machine will also require one less part-time employee which would result in pre-tax savings of $35,000 per year. Maintenance costs are also expected to be substantially lower with an annual pre-tax saving of $15,000 per year. Average accounts receivable will increase from $45,000 to $58.000 while accounts payable will increase by $8.000. Inventory is also expected to increase by $22.000. Assume that these changes are expected to occur immediately. The old machine was originally purchased for $250.000 and has a book value of $50, 000. The old machine could be sold today for $35.000 but if retained and operated for a further five years it would only be worth $10, 000. The new machine currently costs $450, 000 and requires $50.000 installation costs. In 5 yearsprime time the machine could be sold for $170, 000. New Zealand taxation rules allow depreciation on a straight-line basis over 10 years; however management reports to shareholders using the straight line method over 20 years. The company tax rate is 28%. Calculate the initial investment associated with the proposed replacement decision. Calculate the incremental operating cash flow in year 1 associated with the proposed replacement decision. Calculate the terminal value associated with the proposed replacement decision

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts