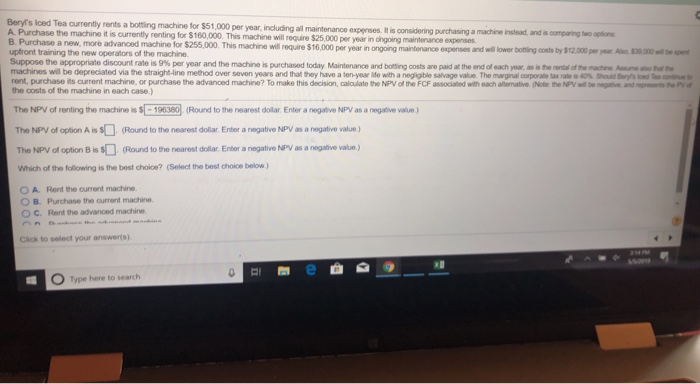

Question: tried this problem and i csnt get passed bumver 1. please help!!! please anser all parts and show work! thank you! I Beryr's Iced Tea

I Beryr's Iced Tea currently rents a botting machine for A Purchase the machine i B. Purchase a new, more advanced machine for $255,000. This upfront training the new operators of the machine Suppose the appropriate discount rate is 9% per year and the machine s $51,000 per year, including all maintenance expenses. tis considering purchasinga t is currently renting for $160,000. This machine will roquire $25,000 per year in ongoing maintenance expenses machine instead, and is comparing two options machine will ro are $ 16,000 per year r, ongongmantenance oxpenses and wil lower b ng costs by S12,000 require $16,000 Am m.dbe prchased today Maintenance and boting costs ao padat te end of each as she woroftwmono Aursmhrhe machines will be depreciated via the straight-line method over seven years and that they have a ten-year ie with a negiible salvage value. The marginal corporate tax rate is 40%S Shoult Seryls lod rent, purchase its current machine, or purchase the advanoed machine? To make this decision, caloulate the NPV of the FCF associated vwlth each alternative. (Note the NPV llbe egtive and ee Pa the costs of the machine in each case.) The NPV of renting the machine is s -196380(Round to the nearest dollar Enter a negative NPV as a negative value ) The NPV of option A is(Round to the nearest dolar Enter a negative NPV as a negative value) The NPV of option B is(Round to the nearest dollar. Enter a negative NPV as a negastive value) Which of the following is the best choioe? (Select the best choice below) O A. Rent the current machine. O B. Purchase the current machine O C. Rent the advanced machine Click to select your answerts) et O Type here to search

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts