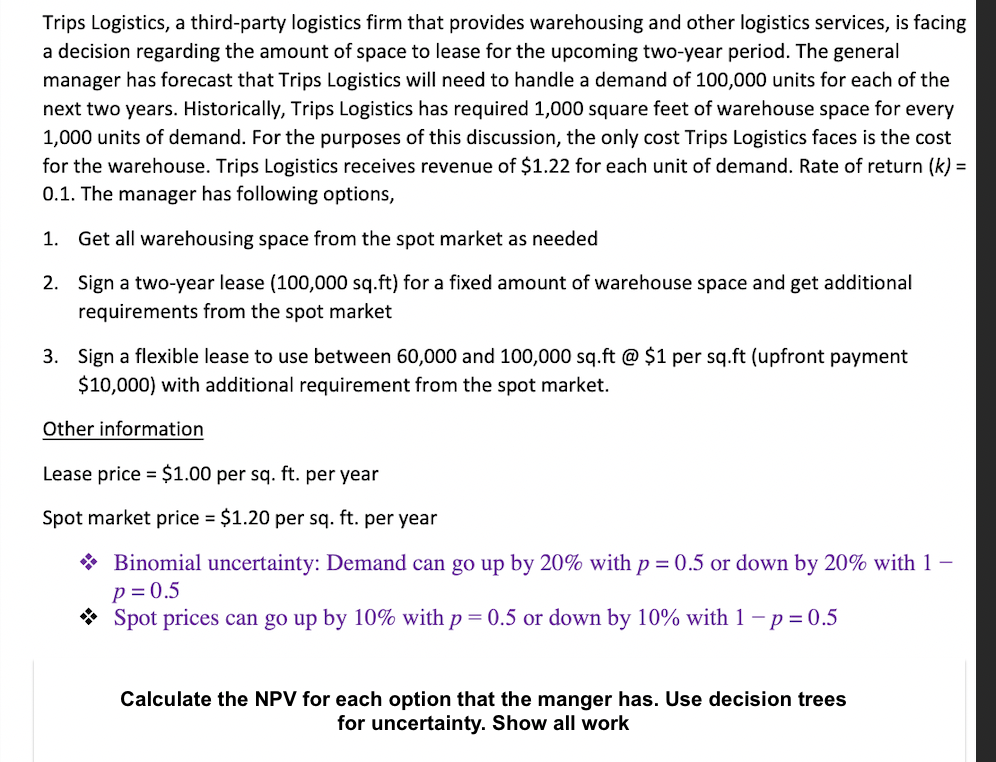

Question: Trips Logistics, a third - party logistics firm that provides warehousing and other logistics services, is facing a decision regarding the amount of space to

Trips Logistics, a thirdparty logistics firm that provides warehousing and other logistics services, is facing

a decision regarding the amount of space to lease for the upcoming twoyear period. The general

manager has forecast that Trips Logistics will need to handle a demand of units for each of the

next two years. Historically, Trips Logistics has required square feet of warehouse space for every

units of demand. For the purposes of this discussion, the only cost Trips Logistics faces is the cost

for the warehouse. Trips Logistics receives revenue of $ for each unit of demand. Rate of return

The manager has following options,

Get all warehousing space from the spot market as needed

Sign a twoyear lease for a fixed amount of warehouse space and get additional

requirements from the spot market

Sign a flexible lease to use between and sqft @ $ per sqft upfront payment

$ with additional requirement from the spot market.

Other information

Lease price $ per sq ft per year

Spot market price $ per sq ft per year

& Binomial uncertainty: Demand can go up by with or down by with

Spot prices can go up by with or down by with

Calculate the NPV for each option that the manger has. Use decision trees

for uncertainty. Show all work and calculations

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock