Question: Trish Himple return: Forms possibly used in this return - Schedule C, Form 4562, Form 8829. Trish will claim depreciation expense on line 13 of

Trish Himple return: Forms possibly used in this return - Schedule C, Form 4562, Form 8829.

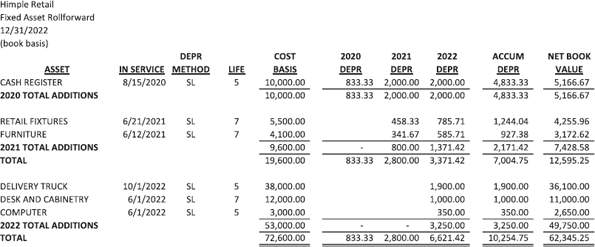

- Trish will claim depreciation expense on line 13 of Schedule C. She has six (6) assets to depreciate. Make sure you record the assets using the correct year in your depreciation register. Line 14 of Form 4562 is for current year bonus depreciation and line 17 is for depreciation taken in the current year for assets placed in service in prior years. Those are the only two lines affected on Form 4562.

- Do you need to file Form 8829? If not, why not? Hint: Can Trish use the simplified method to claim a home office deduction?

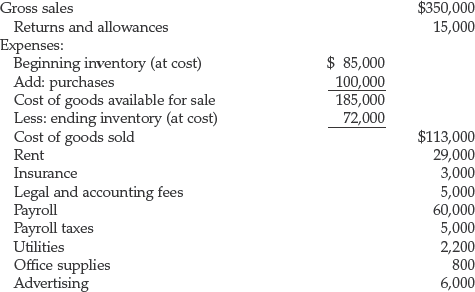

Trish Himple owns a retail family clothing store. Her store is located at 4321 Heather Drive, Henderson, NV 89002. Her employer identification number is 95-1234321 and her Social Security number is 123-45-6789. Trish keeps her books on the cash basis. The income and expenses for the year are:

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts