Question: TRODUCTORY PROJECT VALUATION Steve's Sub Stop (Steve's) is c coaster ovens for each of its 120 stores located in the southweste gh-capacity conveyor toaster ovens,

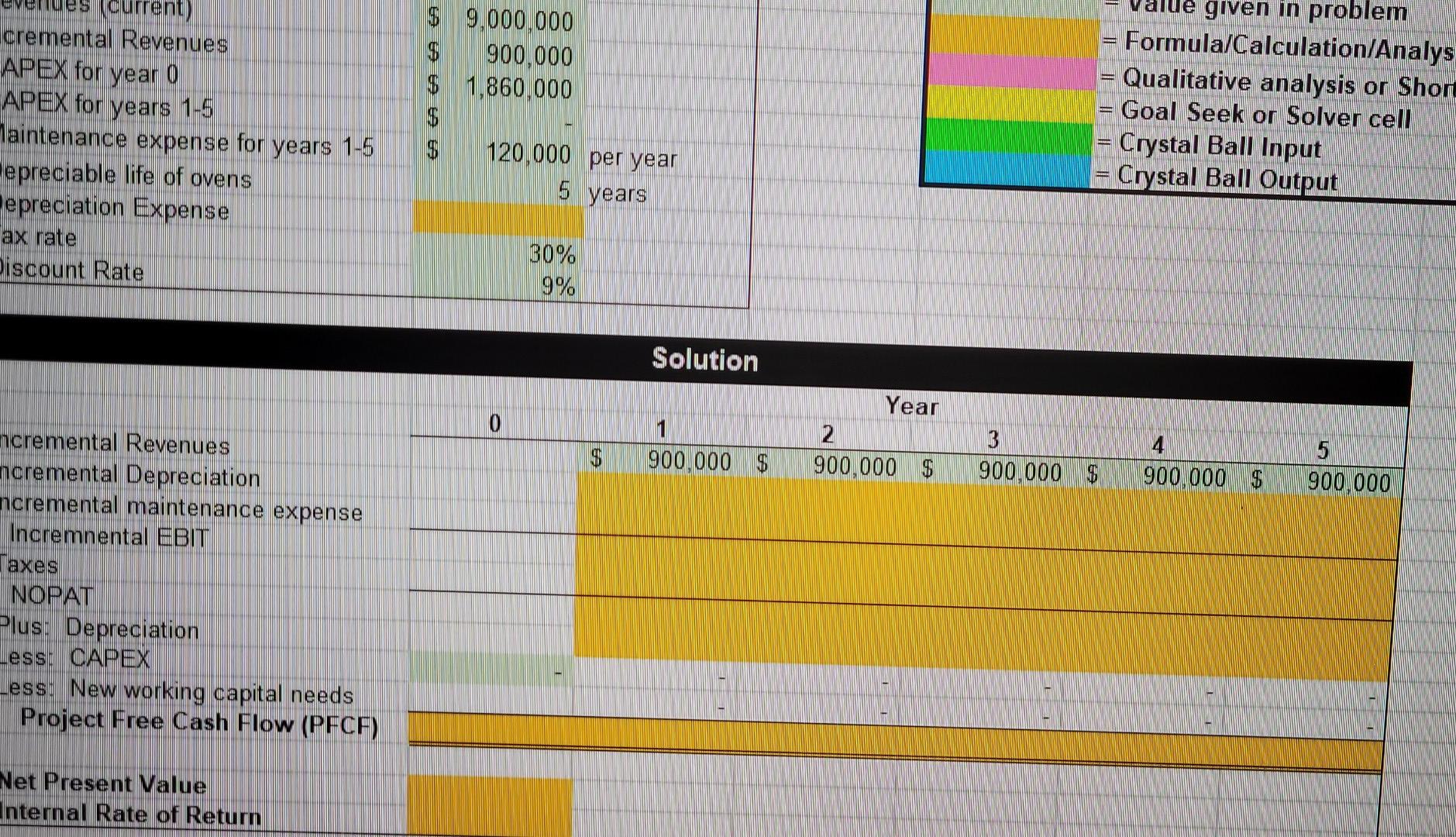

TRODUCTORY PROJECT VALUATION Steve's Sub Stop (Steve's) is c coaster ovens for each of its 120 stores located in the southweste gh-capacity conveyor toaster ovens, manufactured by Lincoln, will ment of $15.000 per store plus $500 in installation costs, for a to 2000. The new capital (including the costs for installation) will be ears using straight-line depreciation toward a zero salvage value. additional maintenance expenses totaling $120.000 per year to ma esent, firm revenues for the 120 stores total $9 million, and the con dding the toaster feature will increase revenues by 10%. i Steve's faces a 30% tax rate, what expected project FCFs for each ears will result from the investment in toaster ovens? f Steve's uses a 9% discount rate to analyze its investments in its sto oroject's NPVI Should there se ta ues (current) cremental Revenues APEX for year 0 APEX for years 1-5 laintenance expense for years 1-5 epreciable life of ovens epreciation Expense ax rate Discount Rate $ 9,000,000 $ 900.000 $ 1,860,000 $ $ 120,000 per year | | || | T value given in problem Formula/Calculation/Analys Qualitative analysis or Short Goal Seek or Solver cell Crystal Ball Input Crystal Ball Output 5 years 30% 9% Solution 0 1 900,000 $ Year 2 900,000 $ $ 3 900,000 $ 4 900,000 $ 5 900.000 ncremental Revenues ncremental Depreciation ncremental maintenance expense Incremnental EBIT Taxes NOPAT Plus. Depreciation ess. CAPEX Less: New working capital needs Project Free Cash Flow (PFCF) Net Present Value Internal Rate of Retum TRODUCTORY PROJECT VALUATION Steve's Sub Stop (Steve's) is c coaster ovens for each of its 120 stores located in the southweste gh-capacity conveyor toaster ovens, manufactured by Lincoln, will ment of $15.000 per store plus $500 in installation costs, for a to 2000. The new capital (including the costs for installation) will be ears using straight-line depreciation toward a zero salvage value. additional maintenance expenses totaling $120.000 per year to ma esent, firm revenues for the 120 stores total $9 million, and the con dding the toaster feature will increase revenues by 10%. i Steve's faces a 30% tax rate, what expected project FCFs for each ears will result from the investment in toaster ovens? f Steve's uses a 9% discount rate to analyze its investments in its sto oroject's NPVI Should there se ta ues (current) cremental Revenues APEX for year 0 APEX for years 1-5 laintenance expense for years 1-5 epreciable life of ovens epreciation Expense ax rate Discount Rate $ 9,000,000 $ 900.000 $ 1,860,000 $ $ 120,000 per year | | || | T value given in problem Formula/Calculation/Analys Qualitative analysis or Short Goal Seek or Solver cell Crystal Ball Input Crystal Ball Output 5 years 30% 9% Solution 0 1 900,000 $ Year 2 900,000 $ $ 3 900,000 $ 4 900,000 $ 5 900.000 ncremental Revenues ncremental Depreciation ncremental maintenance expense Incremnental EBIT Taxes NOPAT Plus. Depreciation ess. CAPEX Less: New working capital needs Project Free Cash Flow (PFCF) Net Present Value Internal Rate of Retum

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts