Question: Trouble with Excel to help me solve this problem Alapaha Company's income from operations for the past three years is presented below ALAPAHA COMPANY INCOME

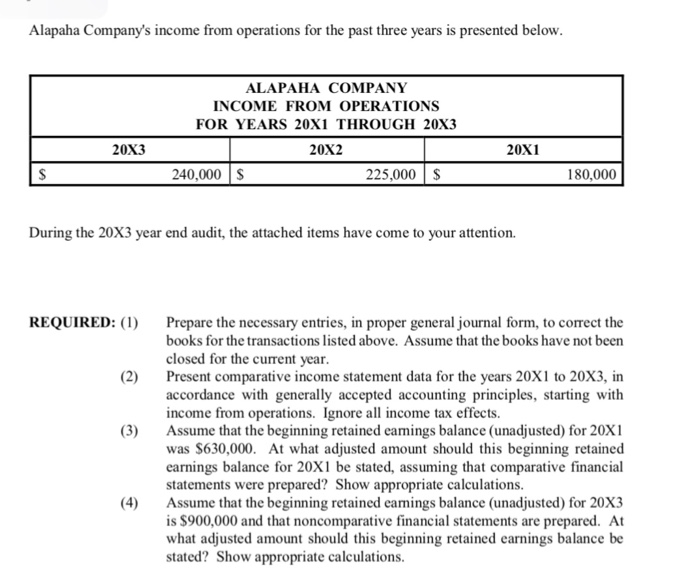

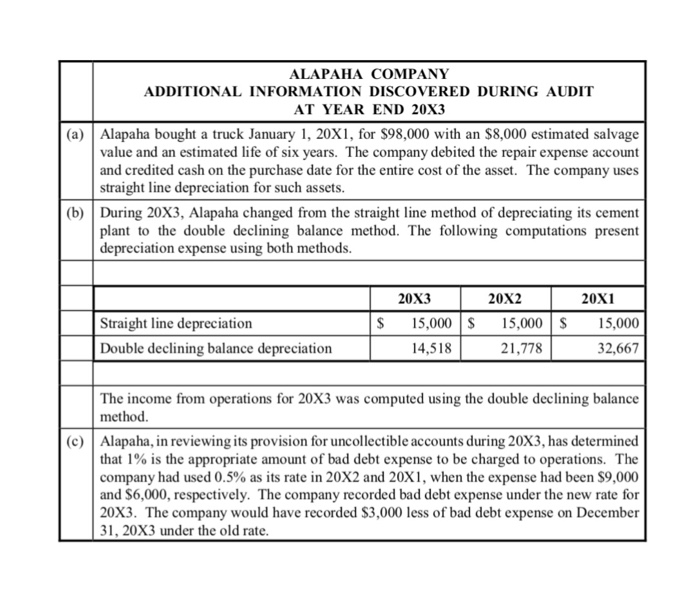

Alapaha Company's income from operations for the past three years is presented below ALAPAHA COMPANY INCOME FROM OPERATIONS FOR YEARS 20X1 THROUGH 20X3 20X2 20X3 20X1 240,000 S 225,000 $ 180,000 During the 20X3 year end audit, the attached items have come to your attention. REQUIRED:( Prepare the necessary entries, in proper general journal form, to correct the books for the transactions listed above. Assume that the books have not been closed for the current year Present comparative income statement data for the years 20X1 to 20X3, in accordance with generally accepted accounting principles, starting with income from operations. Ignore all income tax effects. Assume that the beginning retained eamings balance (unadjusted) for 20XI was S630,000. At what adjusted amount should this beginning retained earnings balance for 20X1 be stated, assuming that comparative financial statements were prepared? Show appropriate calculations (2) (3) 4) Assume that the beginning retained eamings balance (unadjusted) for 20X3 is $900,000 and that noncomparative financial statements are prepared. At what adjusted amount should this beginning retained earnings balance be stated? Show appropriate calculations ALAPAHA COMPANY ADDITIONAL INFORMATION DISCOVERED DURING AUDIT AT YEAR END 20X3 (a) Alapaha bought a truck January 1, 20X1, for S98,000 with an $8,000 estimated salvage value and an estimated life of six years. The company debited the repair expense account and credited cash on the purchase date for the entire cost of the asset. The company uses straight line depreciation for such assets. (b)During 20X3, Alapaha changed from the straight ine method of depreciating its cement plant to the double declining balance method. The following computations present depreciation expense using both methods. 20X3 20X2 20X1 $ 15,000 S 15,000 15,000 Straight line depreciation Double declining balance depreciation 4,518 21,778 32,667 The income from operations for 20X3 was computed using the double declining balance method. (c) Alapaha, in reviewing its provision for uncollectible accounts during 20X3, has determined that 1% is the appropriate amount of bad debt expense to be charged to operations. The company had used 0.5% as its rate in 20X2 and 20X1, when the expense had been $9,000 and S6,000, respectively. The company recorded bad debt expense under the new rate for 20X3. The company would have recorded $3,000 less of bad debt expense on December 31, 20X3 under the old rate

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts