Question: True and False (1 point each) For the true and false problems, please write the entire word True or False in the space provided. 1.)

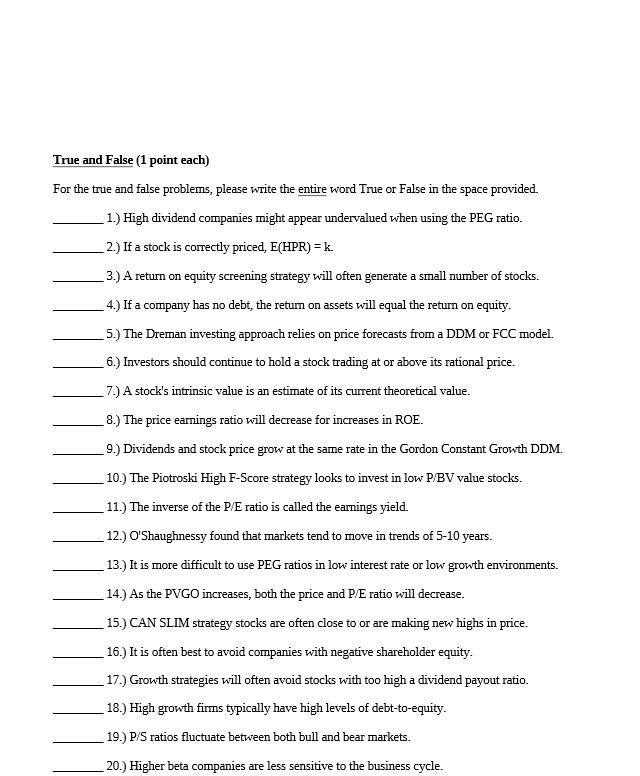

True and False (1 point each) For the true and false problems, please write the entire word True or False in the space provided. 1.) High dividend companies might appear undervalued when using the PEG ratio. 2.) If a stock is correctly priced, E(HPR) = k. 3.) A return on equity screening strategy will often generate a small number of stocks. 4.) If a company has no debt, the return on assets will equal the return on equity. 5.) The Dreman investing approach relies on price forecasts from a DDM or FCC model. 6.) Investors should continue to hold a stock trading at or above its rational price. 7.) A stock's intrinsic value is an estimate of its current theoretical value. B.) The price earnings ratio will decrease for increases in ROE. 9.) Dividends and stock price grow at the same rate in the Gordon Constant Growth DDM. 10.) The Piotroski High F-Score strategy looks to invest in low P/BV value stocks. 11.) The inverse of the P/E ratio is called the earnings yield. 12.) O'Shaughnessy found that markets tend to move in trends of 5-10 years. 13.) It is more difficult to use PEG ratios in low interest rate or low growth environments. 14.) As the PVGO increases, both the price and P/E ratio will decrease. 15.) CAN SLIM strategy stocks are often close to or are making new highs in price. 16.) It is often best to avoid companies with negative shareholder equity. 17.) Growth strategies will often avoid stocks with too high a dividend payout ratio. 18.) High growth firms typically have high levels of debt-to-equity. 19.) P/'S ratios fluctuate between both bull and bear markets. 20.) Higher beta companies are less sensitive to the business cycle

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts