Question: True / False # 1 : The questions below cover everything from the Time Value module that will be on the exam, so all I

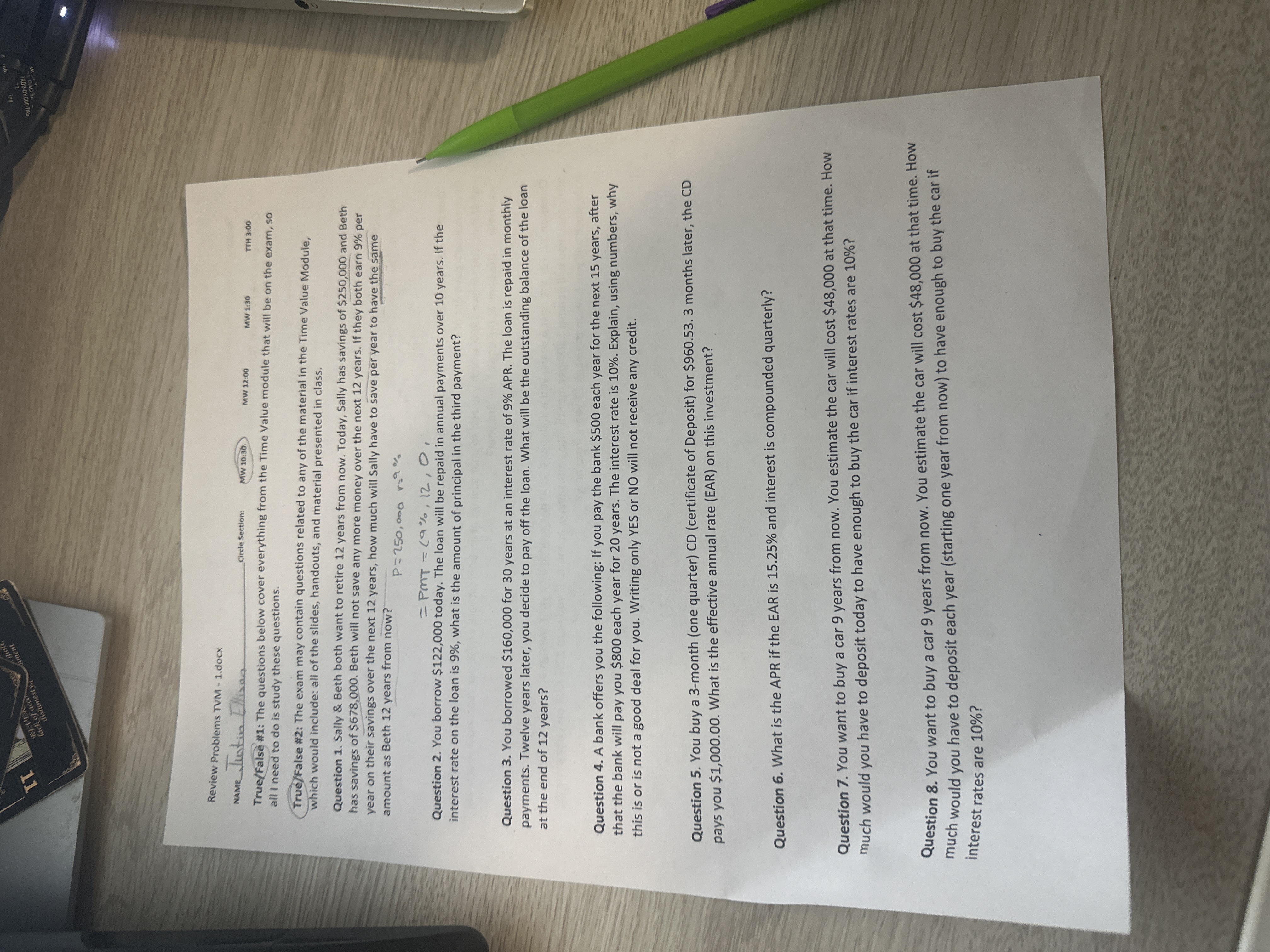

TrueFalse #: The questions below cover everything from the Time Value module that will be on the exam, so all I need to do is study these questions. TrueFalse #: The exam may contain questions related to any of the material in the Time Value Module, which would include: all of the slides, handouts, and material presented in class. Question Sally & Beth both want to retire years from now. Today, Sally has savings of $ and Beth has savings of $ Beth will not save any more money over the next years. If they both earn per year on their savings over the next years, how much will Sally have to save per year to have the same amount as Beth years from now? Question You borrow $ today. The loan will be repaid in annual payments over years. If the interest rate on the loan is what is the amount of principal in the third payment? Question You borrowed $ for years at an interest rate of APR. The loan is repaid in monthly payments. Twelve years later, you decide to pay off the loan. What will be the outstanding balance of the loan at the end of years? Question A bank offers you the following: If you pay the bank $ each year for the next years, after that the bank will pay you $ each year for years. The interest rate is Explain, using numbers, why this is or is not a good deal for you. Writing only YES or NO will not receive any credit. Question You buy a month one quarter CD certificate of Deposit for $ months later, the pays you $ What is the effective annual rate EAR on this investment? Question What is the APR if the EAR is and interest is compounded quarterly? Question You want to buy a car years from now. You estimate the car will cost $ at that time. How much would you have to deposit today to have enough to buy the car if interest rates are Question You want to buy a car years from now. You estimate the car will cost $ at that time. How much would you have to deposit each year starting one year from now to have enough to buy the car if interest rates are

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock