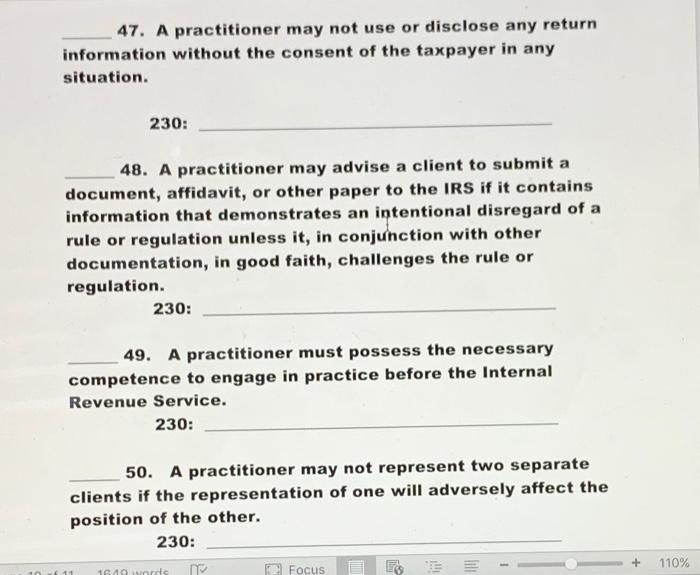

Question: true/ false 47. A practitioner may not use or disclose any return information without the consent of the taxpayer in any situation. 230: 48. A

47. A practitioner may not use or disclose any return information without the consent of the taxpayer in any situation. 230: 48. A practitioner may advise a client to submit a document, affidavit, or other paper to the IRS if it contains information that demonstrates an intentional disregard of a rule or regulation unless it, in conjunction with other documentation, in good faith, challenges the rule or regulation. 230: 49. A practitioner must possess the necessary competence to engage in practice before the Internal Revenue Service. 230: 50. A practitioner may not represent two separate clients if the representation of one will adversely affect the position of the other. 230: 110% Focus 11 Arcs

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts