Question: True False (5 Questions, 2 Points Each) 1. If the yield to maturity is greater than the coupon rate, the price of the bond is

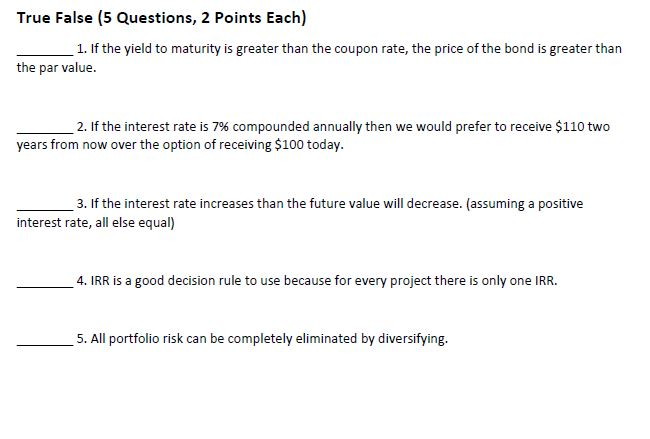

True False (5 Questions, 2 Points Each) 1. If the yield to maturity is greater than the coupon rate, the price of the bond is greater than the par value. 2If the interest rate is 7% compounded annually then we would prefer to receive $110 two years from now over the option of receiving $100 today. 3. If the interest rate increases than the future value will decrease. (assuming a positive interest rate, all else equal) 4. IRR is a good decision rule to use because for every project there is only one IRR 5. All portfolio risk can be completely eliminated by diversifying

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts