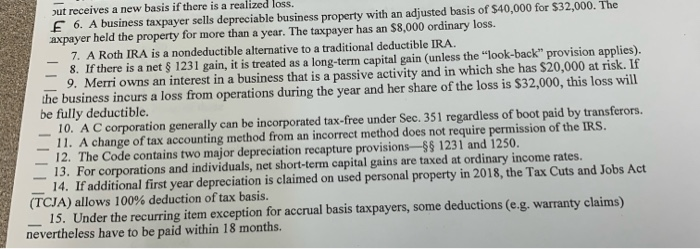

Question: True/ False Jul receives & HOW basis If there is a realized 1055. 6. A business taxpayer sells depreciable business property with an adjusted basis

Jul receives & HOW basis If there is a realized 1055. 6. A business taxpayer sells depreciable business property with an adjusted basis of $40,000 for $32,000. The axpayer held the property for more than a year. The taxpayer has an $8,000 ordinary loss. 7. A Roth IRA is a nondeductible alternative to a traditional deductible IRA. 8. If there is a net & 1231 gain, it is treated as a long-term capital gain (unless the "look-back" provision applies). . Mer owns an interest in a business that is a passive activity and in which she has $20,000 at risk. If the business incurs a loss from operations during the year and her share of the loss is $32,000, this loss will be fully deductible. 10. A C corporation generally can be incorporated tax-free under Sec. 351 regardless of boot paid by transferors. thod from an incorrect method does not require permission of the IRS. 12. The Code contains two major depreciation recapture provisions --$5 1231 and 1250. 13. For corporations and individuals, net short-term capital gains are taxed at ordinary income rates. - 14. If additional first year depreciation is claimed on used personal property in 2018, the Tax Cuts and Jobs Act (TCJA) allows 100% deduction of tax basis. 15. Under the recurring item exception for accrual basis taxpayers, some deductions (e.g. warranty claims) nevertheless have to be paid within 18 months. - 13. The Code of taxe

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts