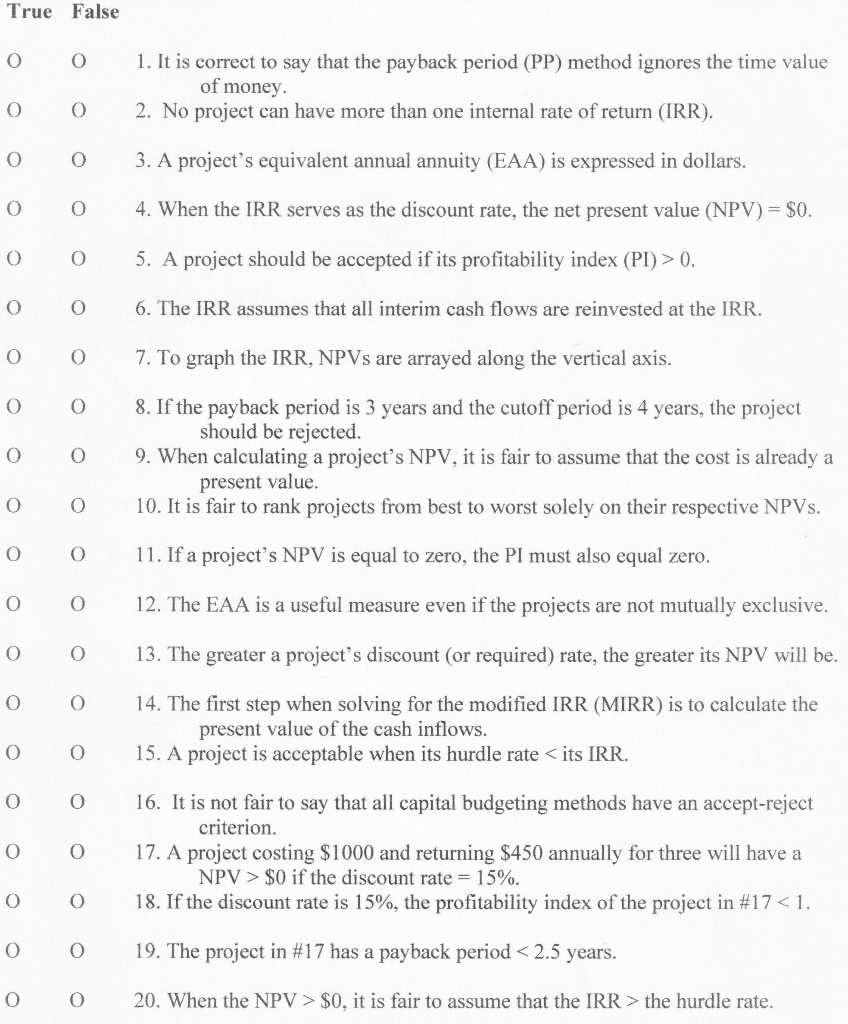

Question: True False O 0 1. It is correct to say that the payback period (PP) method ignores the time value of money 2. No project

True False O 0 1. It is correct to say that the payback period (PP) method ignores the time value of money 2. No project can have more than one internal rate of return (IRR). O O O O 3. A project's equivalent annual annuity (EAA) is expressed in dollars. O 0 4. When the IRR serves as the discount rate, the net present value (NPV) = $0. 0 O 5. A project should be accepted if its profitability index (PI) > 0. 0 O 6. The IRR assumes that all interim cash flows are reinvested at the IRR. O O 7. To graph the IRR, NPVs are arrayed along the vertical axis. O o O 0 8. If the payback period is 3 years and the cutoff period is 4 years, the project should be rejected. 9. When calculating a project's NPV, it is fair to assume that the cost is already a present value. 10. It is fair to rank projects from best to worst solely on their respective NPVs. 11. If a project's NPV is equal to zero, the PI must also equal zero. O O O O 0 0 12. The EAA is a useful measure even if the projects are not mutually exclusive. O O 13. The greater a project's discount (or required) rate, the greater its NPV will be. O 0 14. The first step when solving for the modified IRR (MIRR) is to calculate the present value of the cash inflows. 15. A project is acceptable when its hurdle rate

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts