Question: True / False Questions 1. Activity-based costing (ABC) is a two-stage cost allocation system that (1)Jallocates costs to activities and (2) then to products based

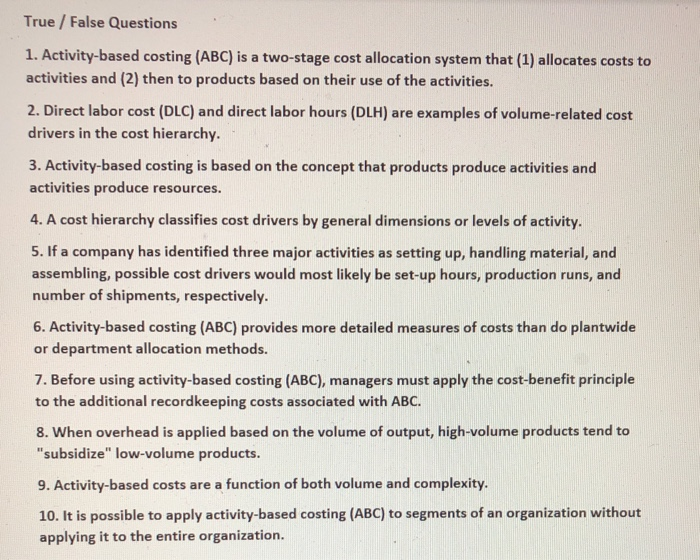

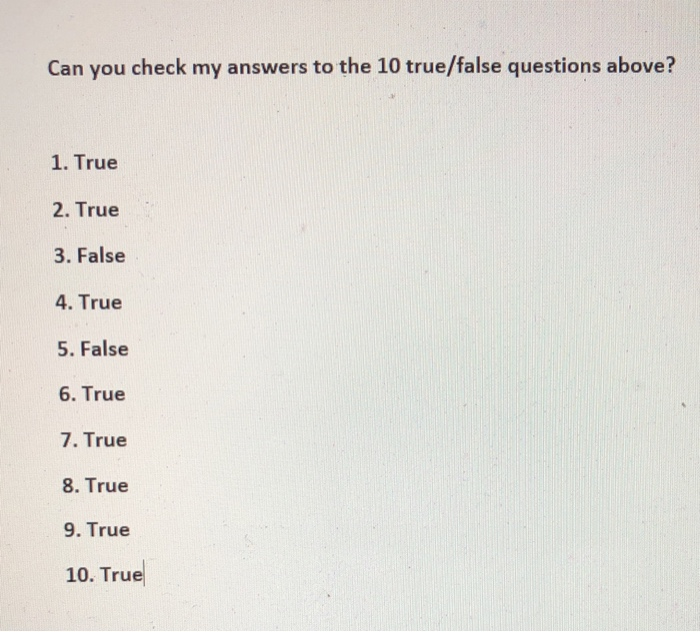

True / False Questions 1. Activity-based costing (ABC) is a two-stage cost allocation system that (1)Jallocates costs to activities and (2) then to products based on their use of the activities. 2. Direct labor cost (DLC) and direct labor hours (DLH) are examples of volume-related cost drivers in the cost hierarchy. 3. Activity-based costing is based on the concept that products produce activities and activities produce resources. 4. A cost hierarchy classifies cost drivers by general dimensions or levels of activity. 5. If a company has identified three major activities as setting up, handling material, and assembling, possible cost drivers would most likely be set-up hours, production runs, and number of shipments, respectively. 6. Activity-based costing (ABC) provides more detailed measures of costs than do plantwide or department allocation methods. 7. Before using activity-based costing (ABC), managers must apply the cost-benefit principle to the additional recordkeeping costs associated with ABC. 8. When overhead is applied based on the volume of output, high-volume products tend to "subsidize" low-volume products. 9. Activity-based costs are a function of both volume and complexity. 10. It is possible to apply activity-based costing (ABC) to segments of an organization without applying it to the entire organization. True / False Questions 1. Activity-based costing (ABC) is a two-stage cost allocation system that (1)Jallocates costs to activities and (2) then to products based on their use of the activities. 2. Direct labor cost (DLC) and direct labor hours (DLH) are examples of volume-related cost drivers in the cost hierarchy. 3. Activity-based costing is based on the concept that products produce activities and activities produce resources. 4. A cost hierarchy classifies cost drivers by general dimensions or levels of activity. 5. If a company has identified three major activities as setting up, handling material, and assembling, possible cost drivers would most likely be set-up hours, production runs, and number of shipments, respectively. 6. Activity-based costing (ABC) provides more detailed measures of costs than do plantwide or department allocation methods. 7. Before using activity-based costing (ABC), managers must apply the cost-benefit principle to the additional recordkeeping costs associated with ABC. 8. When overhead is applied based on the volume of output, high-volume products tend to "subsidize" low-volume products. 9. Activity-based costs are a function of both volume and complexity. 10. It is possible to apply activity-based costing (ABC) to segments of an organization without applying it to the entire organization

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts