Question: TRUE FALSE Questions 1) The major difference between a cash basis accounting system and an accrual basis accounting system is the timing of recording revenues

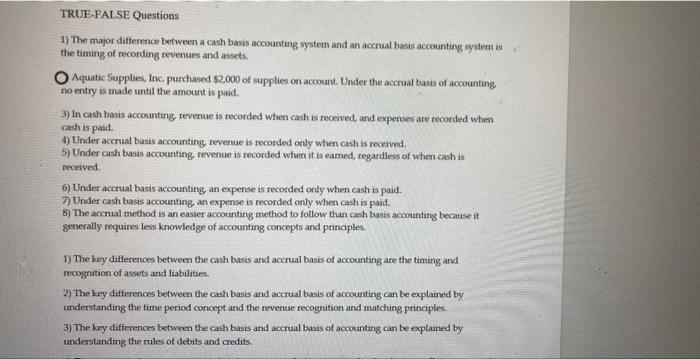

TRUE FALSE Questions 1) The major difference between a cash basis accounting system and an accrual basis accounting system is the timing of recording revenues and assets. Aquatic Supplies, Inc. purchased $2,000 of supplies on account. Under the accrual basis of accounting no entry is made until the amount is paid. 3) In cash basis accounting revenue is recorded when cash is received and expenses are recorded when cash is paid. 4) Under accrual basis accounting, revenue is recorded only when cash is received, 5) Under cash basis accounting, revenue is recorded when it is eamed, regardless of when cash is received 6) Under accrual basis accounting an expense is recorded only when cash is paid. 7) Under cash basis accounting an expense is recorded only when cash is paid. 8) The accrual method is an easier accounting method to follow than cash basis accounting because it generally requires less knowledge of accounting concepts and principles. 1) The key differences between the cash basis and accrual basis of accounting are the timing and recognition of assets and liabilities. 2) The key differences between the cash basis and accrual basis of accounting can be explained by understanding the time period concept and the revenue recognition and matching prinaples. 3) The key differences between the cash basis and accrual basis of accounting can be explained by understanding the rules of debits and credits

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts