Question: true false, short answer and multiple choose 19) gamgo Ltd. leased oor space in a new ofce building. Rent will cost $10,000 per month for

true false, short answer and multiple choose

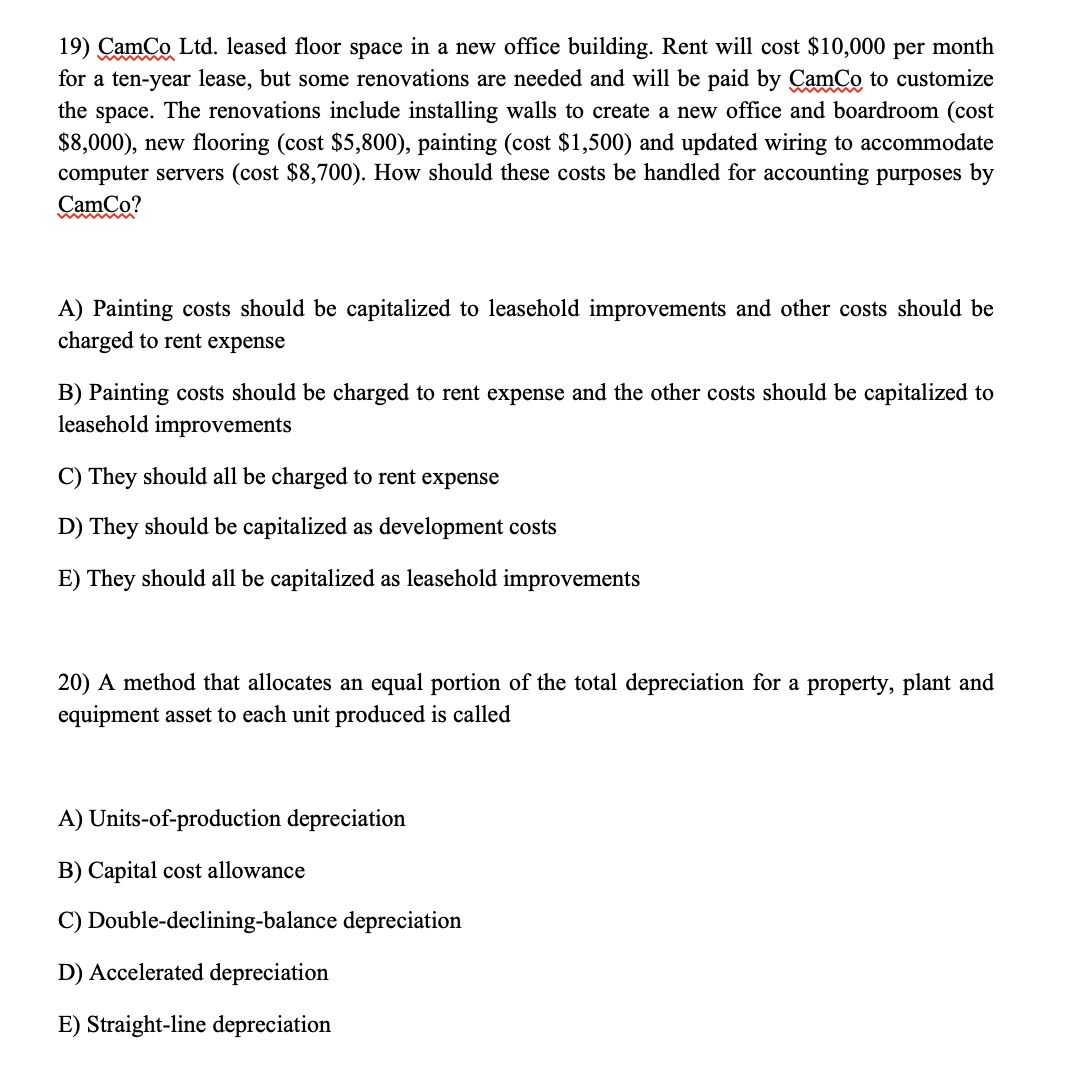

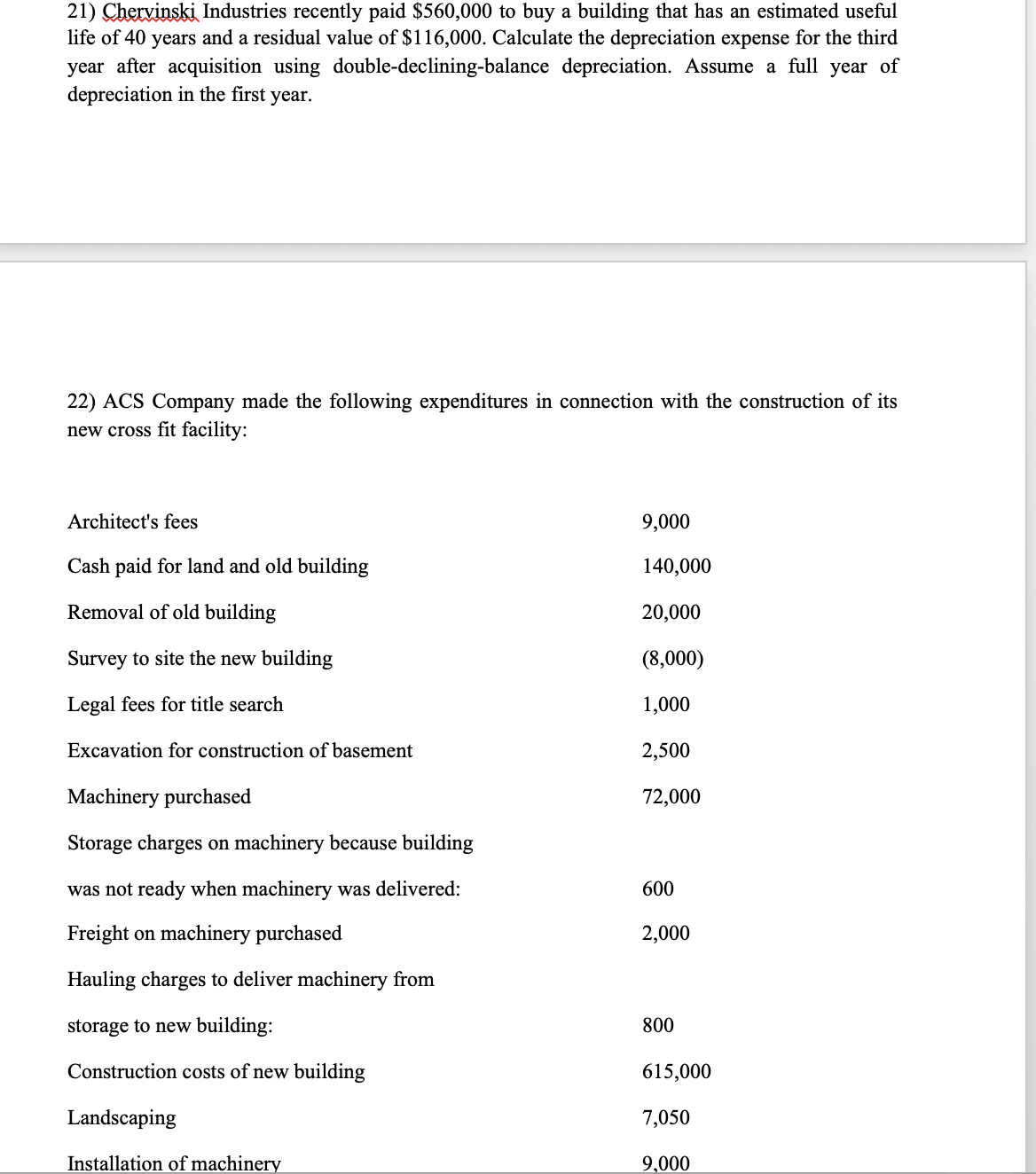

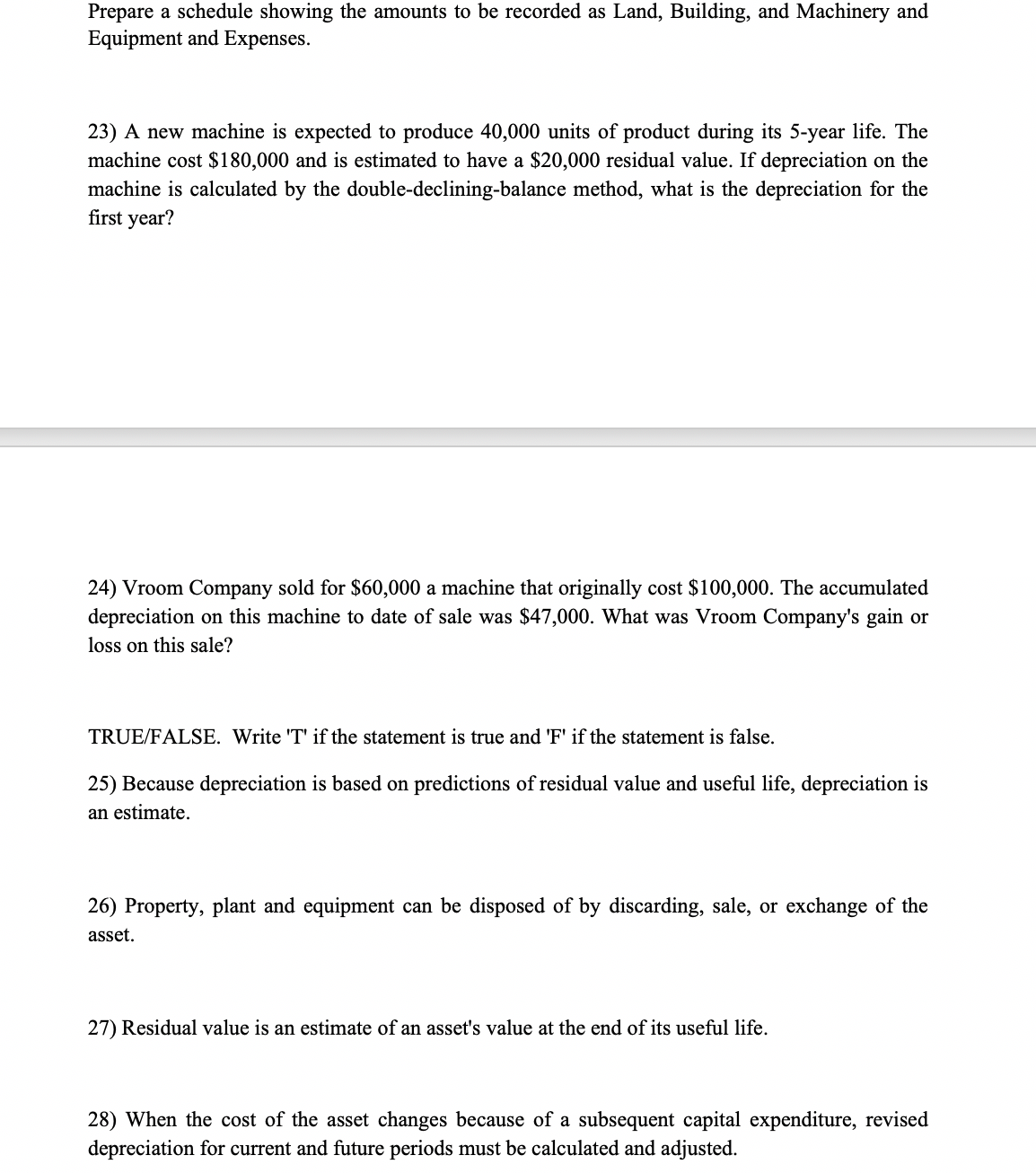

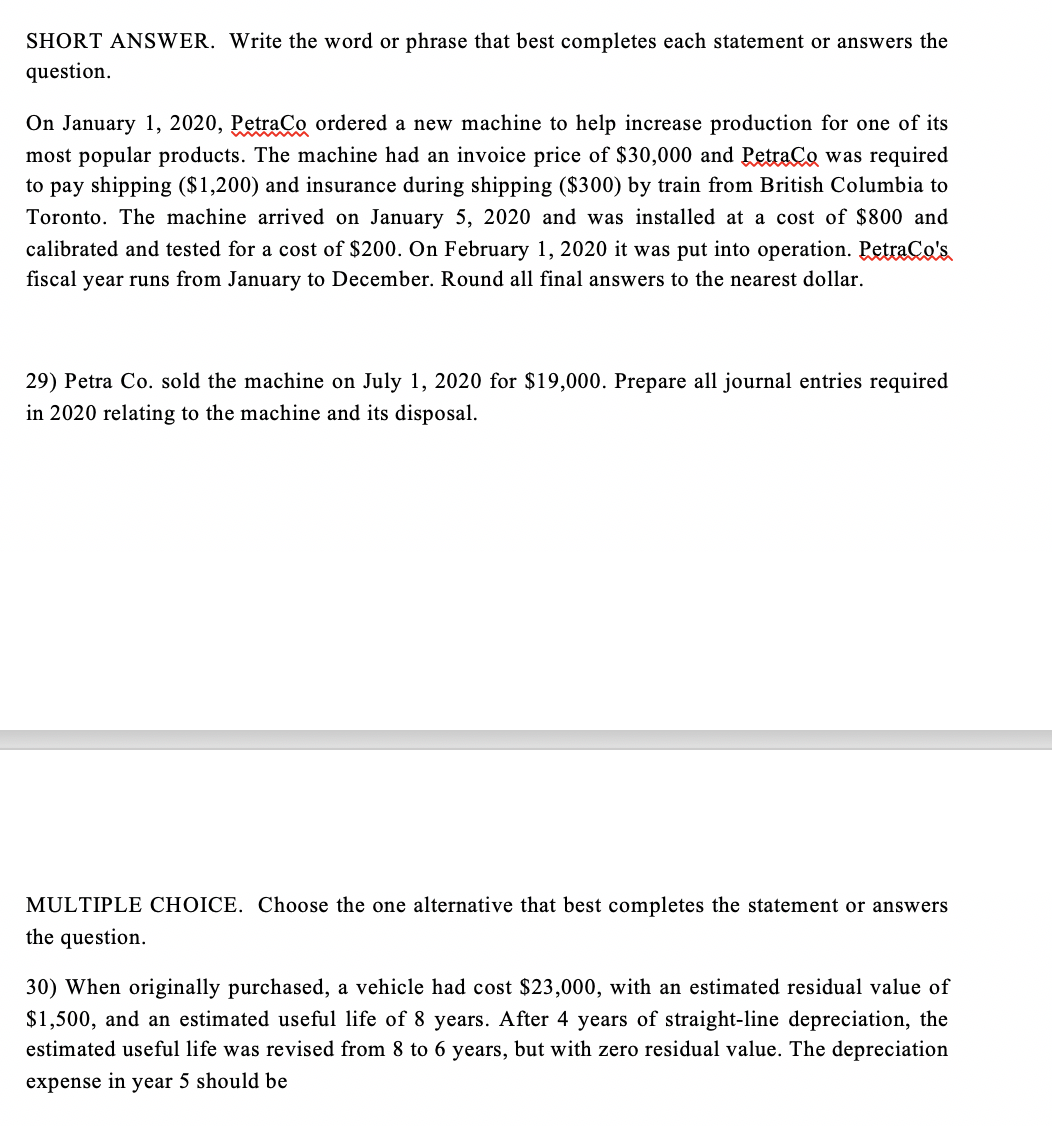

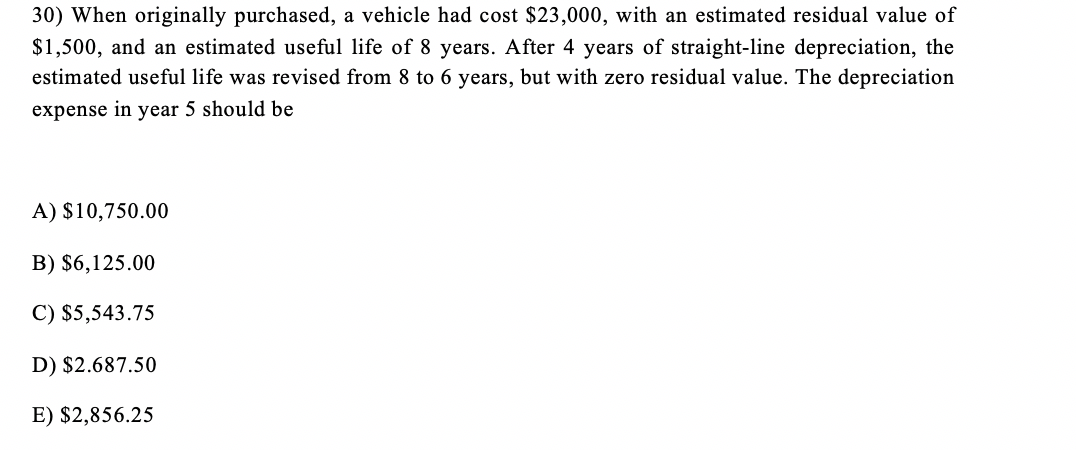

19) gamgo Ltd. leased oor space in a new ofce building. Rent will cost $10,000 per month for a ten-year lease, but some renovations are needed and will be paid by gang to customize the space. The renovations include installing walls to create a new ofce and boardroom (cost $8,000), new ooring (cost $5,800), painting (cost $1,500) and updated wiring to accommodate computer servers (cost $8,700). How should these costs be handled for accounting purposes by ggamggo? A) Painting costs should be capitalized to leasehold improvements and other costs should be charged to rent expense B) Painting costs should be charged to rent expense and the other costs should be capitalized to leasehold improvements C) They should all be charged to rent expense D) They should be capitalized as development costs E) They should all be capitalized as leasehold improvements 20) A method that allocates an equal portion of the total depreciation for a property, plant and equipment asset to each unit produced is called A) Units-of-production depreciation B) Capital cost allowance C) Double-declining-balance depreciation D) Accelerated depreciation E) Straight-line depreciation 21) thustries recently paid $560,000 to buy a building that has an estimated useful life of 40 years and a residual value of $116,000. Calculate the depreciation expense for the third year after acquisition using double-declining-balance depreciation. Assume a full year of depreciation in the rst year. 22) ACS Company made the following expenditures in connection with the construction of its new cross t facility: Architect's fees 9,000 Cash paid for land and old building 140,000 Removal of old building 20,000 Survey to site the new building (8,000) Legal fees for title search 1,000 Excavation for construction of basement 2,500 Machinery purchased 72,000 Storage charges on machinery because building was not ready When machinery was delivered: 600 Freight on machinery purchased 2,000 Hauling charges to deliver machinery from storage to new building: 800 Construction costs of new building 615,000 Landscaping 7,050 Installation of mashing 9,000 Prepare a schedule showing the amounts to be recorded as Land, Building, and Machinery and Equipment and Expenses. 23) A new machine is expected to produce 40,000 units of product during its 5-year life. The machine cost $180,000 and is estimated to have a $20,000 residual value. If depreciation on the machine is calculated by the double-declining-balance method, what is the depreciation for the rst year? 24) Vroom Company sold for $60,000 a machine that originally cost $100,000. The accumulated depreciation on this machine to date of sale was $47,000. What was Vroom Company's gain or loss on this sale? TRUEIFALSE. Write 'T' if the statement is true and 'F' if the statement is false. 25) Because depreciation is based on predictions of residual value and useful life, depreciation is an estimate. 26) Property, plant and equipment can be disposed of by discarding, sale, or exchange of the asset. 2'?) Residual value is an estimate of an asset's value at the end of its useful life. 28) When the cost of the asset changes because of a subsequent capital expenditure, revised depreciation for current and future periods must be calculated and adjusted. SHORT ANSWER. Write the word or phrase that best completes each statement or answers the question. On January 1, 2020, Petrago ordered a new machine to help increase production for one of its most popular products. The machine had an invoice price of $30,000 and W was required to pay shipping ($1,200) and insurance during shipping ($300) by train from British Columbia to Toronto. The machine arrived on January 5, 2020 and was installed at a cost of $800 and calibrated and tested for a cost of $200. On February 1, 2020 it was put into operation. W scal year runs from January to December. Round all nal answers to the nearest dollar. 29) Petra Co. sold the machine on July 1, 2020 for $19,000. Prepare all jaurnal entries required in 2020 relating to the machine and its disposal. MULTIPLE CHOICE. Choose the one alternative that best completes the statement or answers the question. 30) When originally purchased, a vehicle had cost $23,000, with an estimated residual value of $1,500, and an estimated useful life of 8 years. After 4 years of straight-line depreciation, the estimated useful life was revised from 8 to 6 years, but with zero residual value. The depreciation expense in year 5 should be 30) When originally purchased, a vehicle had cost $23,000, with an estimated residual value of $1,500, and an estimated useful life of 8 years. After 4 years of straight-line depreciation, the estimated useful life was revised from 8 to 6 years, but with zero residual value. The depreciation expense in year 5 should be A) $10,750.00 B) $6,125 .00 C) $5,543 .75 D) $2,687.50 E) $2,856.25