Question: True or False? (0.5points each): 1. If the interest rate parity holds, money market hedging is superior to forward hedging 2. Monopolies have higher operating

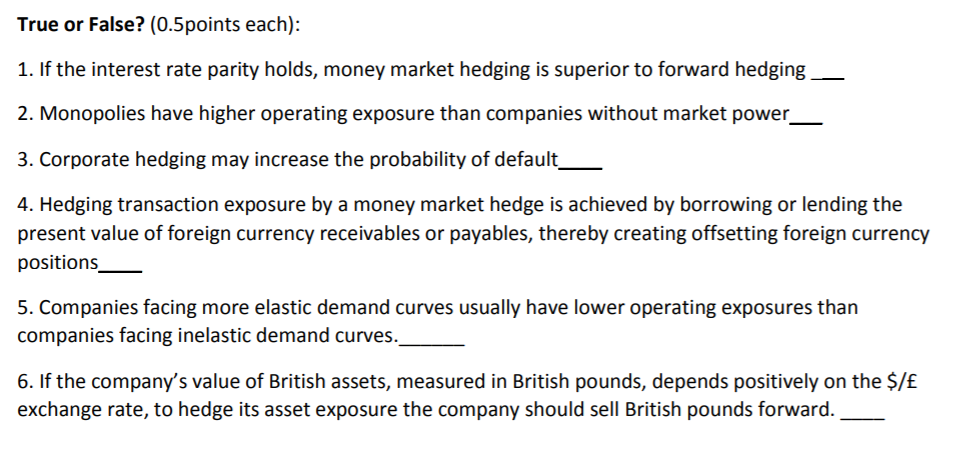

True or False? (0.5points each): 1. If the interest rate parity holds, money market hedging is superior to forward hedging 2. Monopolies have higher operating exposure than companies without market power 3. Corporate hedging may increase the probability of default_ 4. Hedging transaction exposure by a money market hedge is achieved by borrowing or lending the present value of foreign currency receivables or payables, thereby creating offsetting foreign currency positions - 5. Companies facing more elastic demand curves usually have lower operating exposures than companies facing inelastic demand curves. 6. If the company's value of British assets, measured in British pounds, depends positively on the $/ exchange rate, to hedge its asset exposure the company should sell British pounds forward

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts