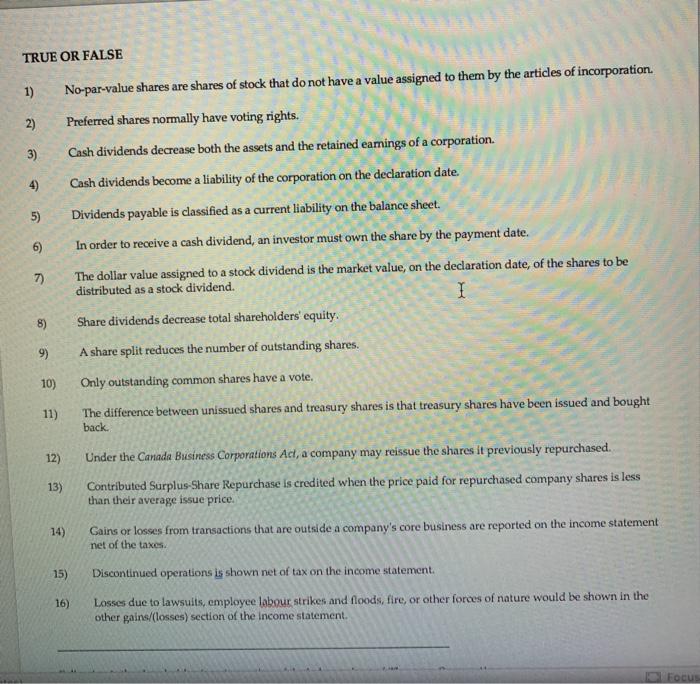

Question: TRUE OR FALSE 1) 2) 3) 9 5) 6) No-par-value shares are shares of stock that do not have a value assigned to them by

TRUE OR FALSE 1) 2) 3) 9 5) 6) No-par-value shares are shares of stock that do not have a value assigned to them by the articles of incorporation. Preferred shares normally have voting rights. Cash dividends decrease both the assets and the retained earnings of a corporation. Cash dividends become a liability of the corporation on the declaration date. Dividends payable is classified as a current liability on the balance sheet. In order to receive a cash dividend, an investor must own the share by the payment date. The dollar value assigned to a stock dividend is the market value, on the declaration date, of the shares to be distributed as a stock dividend. 1 Share dividends decrease total shareholders equity. A share split reduces the number of outstanding shares. Only outstanding common shares have a vote. The difference between unissued shares and treasury shares is that treasury shares have been issued and bought back 7) 8) 9) 10) 11) 12) 13) Under the Canada Business Corporations Ad, a company may reissue the shares it previously repurchased. Contributed Surplus-Share Repurchase is credited when the price paid for repurchased company shares is less than their average issue price. Gains or losses from transactions that are outside a company's core business are reported on the income statement net of the taxes. 14) 15) Discontinued operations is shown net of tax on the income statement. Losses due to lawsuits, employee labour strikes and floods, fire, or other forces of nature would be shown in the other gains/(losses) section of the income statement 16) Focus

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts