Question: True or False _1. When a newly admitted partner pays a bonus to the existing partners, the new partner's capital account is debited to record

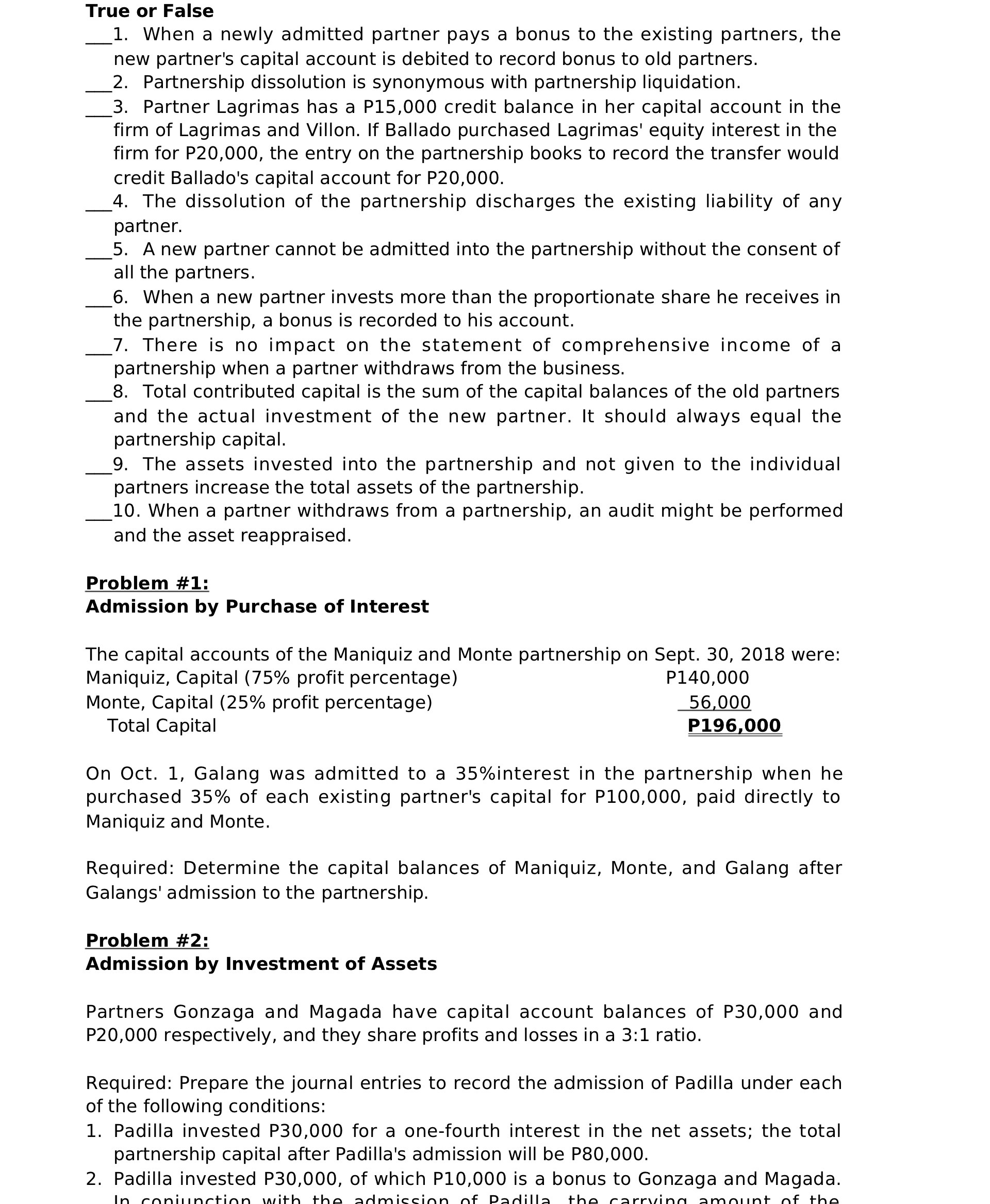

True or False _1. When a newly admitted partner pays a bonus to the existing partners, the new partner's capital account is debited to record bonus to old partners. _2. Partnership dissolution is synonymous with partnership liquidation. _3. Partner Lagrimas has a P15,000 credit balance in her capital account in the firm of Lagrimas and Villon. If Ballado purchased Lagrimas' equity interest in the firm for P20,000, the entry on the partnership books to record the transfer would credit Ballado's capital account for P20,000. ___4. The dissolution of the partnership discharges the existing liability of any partner. ___5. A new partner cannot be admitted into the partnership without the consent of all the partners. ___6. When a new partner invests more than the proportionate share he receives in the partnership, a bonus is recorded to his account. _7. There is no impact on the statement of comprehensive income of a partnership when a partner withdraws from the business. _8. Total contributed capital is the sum of the capital balances of the old partners and the actual investment of the new partner. It should always equal the partnership capital. _9. The assets invested into the partnership and not given to the individual partners increase the total assets of the partnership. #10. When a partner withdraws from a partnership, an audit might be performed and the asset reappraised. Problem #1: Admission by Purchase of Interest The capital accounts of the Maniquiz and Monte partnership on Sept. 30, 2018 were: Maniquiz, Capital (75% profit percentage) Pl40,000 Monte, Capital (25% profit percentage) 56 000 Total Capital P196.000 On Oct. 1, Galang was admitted to a 35%interest in the partnership when he purchased 35% of each existing partner's capital for P100,000, paid directly to Maniquiz and Monte. Required: Determine the capital balances of Maniquiz, Monte, and Galang after Galangs' admission to the partnership. Problem #2: Admission by Investment of Assets Partners Gonzaga and Magada have capital account balances of P30,000 and P20,000 respectively, and they share profits and losses in a 3:1 ratio. Required: Prepare the journal entries to record the admission of Padilla under each of the following conditions: 1. Padilla invested P30,000 for a one-fourth interest in the net assets; the total partnership capital after Padilla's admission will be P80,000. 2. Padilla invested P30,000, of which P10,000 is a bonus to Gonzaga and Magada. In rnnillnrl-inn "with than :rlmiccinn n'F Dar-\"II: l-hn ray-ruin\" :mnnnl- n'F HM