Question: True or False 1 . When no - par ordinary shares without a stated value is issued for cash, the Ordinary Shares account is credited

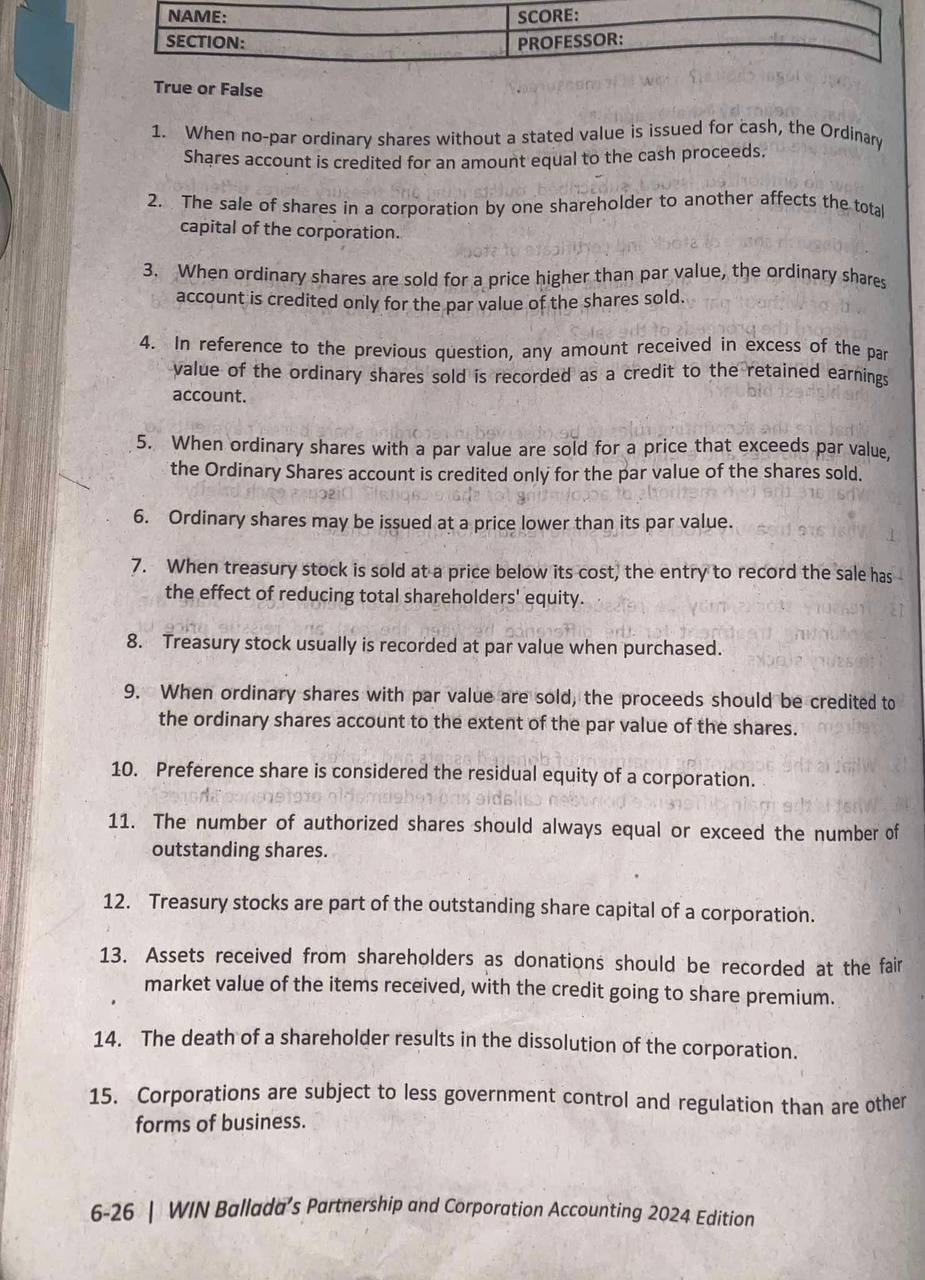

True or False

When nopar ordinary shares without a stated value is issued for cash, the Ordinary Shares account is credited for an amount equal to the cash proceeds.

The sale of shares in a corporation by one shareholder to another affects the total capital of the corporation.

When ordinary shares are sold for a price higher than par value, the ordinary shares account is credited only for the par value of the shares sold.

In reference to the previous question, any amount received in excess of the par value of the ordinary shares sold is recorded as a credit to the retained earnings account.

When ordinary shares with a par value are sold for a price that exceeds par value, the Ordinary Shares account is credited only for the par value of the shares sold.

Ordinary shares may be issued at a price lower than its par value.

When treasury stock is sold at a price below its cost, the entry to record the sale has the effect of reducing total shareholders' equity.

Treasury stock usually is recorded at par value when purchased.

When ordinary shares with par value are sold; the proceeds should be credited to the ordinary shares account to the extent of the par value of the shares.

Preference share is considered the residual equity of a corporation.

The number of authorized shares should always equal or exceed the number of outstanding shares.

Treasury stocks are part of the outstanding share capital of a corporation.

Assets received from shareholders as donations should be recorded at the fair market value of the items received, with the credit going to share premium.

The death of a shareholder results in the dissolution of the corporation.

Corporations are subject to less government control and regulation than are other forms of business. Fair market value is the estimated amount that a willing seller would receive from a financially capable buyer for the sale or exchange of the asset in a free market.

An advantage of the corporate form is the ability of the board to hire professional managers to attend to the corporation's affairs.

In the event of corporate liquidation, shareholders whose stock is preferred as to assets are entitled to receive the par value of their shares before any amounts are distributed to creditors or ordinary shareholders.

The concept of legal capital exists to protect the corporation's assets for the shareholders of the corporation.

The cost of treasury stock is deducted from total share capital and retained earnings in determining total shareholders' equity.

In case of nopar shares, legal capital is the total consideration received by the corporation for the issuance of its shares to the shareholders but this would necessarily exclude the excess of issue price over the stated value.

The Corporation Code prohibits the original issue of share capital for a consideration less than the par or stated value.

The par value of a share of share capital is an indication of the book value of the share of stock.

The highest bidder in a delinquency sale is the person willing to pay the "offer price" that includes the full amount of the subscription balance plus accrued interest, cost of advertisement and expenses of auction sale in exchange for the highest number of shares.

The board of directors carries out the daytoday operations of the business.

The par value of share constitutes the legal capital of a corporation.

The reissuance of treasury stocks at a price above cost results in a gain to be reported in the statement of recognized income and expense.

Shareholders elect the board of directors which appoints the management of a corporation. Fair market value is the estimated amount that a willing seller would receive from a financially capable buyer for the sale or exchange of the asset in a free market.

An advantage of the corporate form is the ability of the board to hire professional managers to attend to the corporation's affairs.

In the event of corporate liquidation, shareholders whose stock is preferred as to assets are entitled to receive the par value of their shares before any amounts are distributed to creditors or ordinary shareholders.

The concept of legal capital exists to protect the corporation's assets for the shareholders of the corporation.

The cost of treasury stock is deducted from total share capital and retained earnings in determining total shareholders' equity.

In case of nopar shares, legal capital is the total consideration received by the corporation for the issuance of its shares to the shareholders but this would necessarily exclude the excess of issue price over the stated value.

The Corporation Code prohibits the original issue of share capital for a consideration less than the par or stated value.

The par value of a share of share capital is an indication of the book value of the share of stock.

The highest bidder in a delinquency sale is the person willing to pay the "offer price" that includes the full am

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock