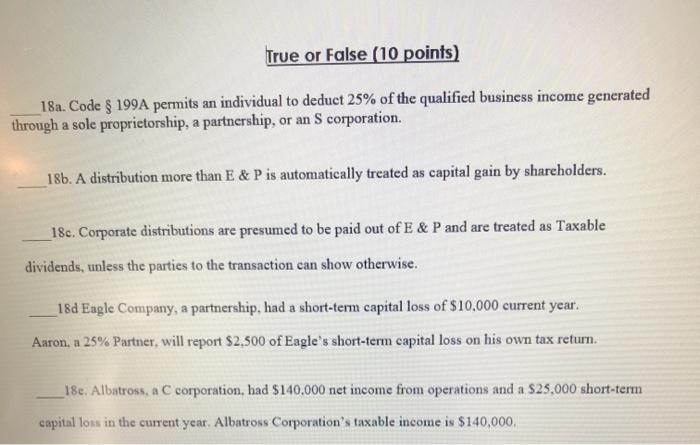

Question: True or False (10 points) 18a. Code $ 199A permits an individual to deduct 25% of the qualified business income generated through a sole proprietorship,

True or False (10 points) 18a. Code $ 199A permits an individual to deduct 25% of the qualified business income generated through a sole proprietorship, a partnership, or an S corporation. 186. A distribution more than E & P is automatically treated as capital gain by shareholders. 18c. Corporate distributions are presumed to be paid out of E & P and are treated as Taxable dividends, unless the parties to the transaction can show otherwise. _18d Eagle Company, a partnership, had a short-term capital loss of $10,000 current year. Aaron, a 25% Partner, will report $2,500 of Eagle's short-term capital loss on his own tax return _18e. Albatross, a C corporation, had $140.000 net income from operations and a $25,000 short-term capital loss in the current year. Albatross Corporation's taxable income is $140,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts