Question: true or false 1-11 True/False Questions (2 Points Each) 1 The financial managers's primary goals are to maximize the market value of their firm and

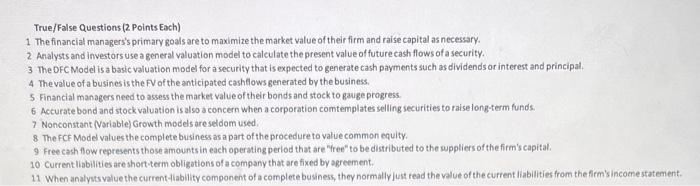

True/False Questions (2 Points Each) 1 The financial managers's primary goals are to maximize the market value of their firm and raise capital as necessary. 2 Analysts and investors use a general valuation model to calculate the present value of future cash flows of a security. 3 The DFC Model is a basic valuation model for a security that is expected to generate cash payments such as dividends or interest and principal. 4 The value of a busines is the FV of the anticipated cashllows generated by the business. 5 Financial managers need to assess the market value of their bonds and stock to gave progress. 6 Accurate bond and stock valuation is also a concern when a corporation comtemplates selling securities to raise longterm funds. 7 Nonconstant (Nariable) Growth models are seldom used: 8 The FCF Model values the complete business as a part of the procedure to value common equity. 9 Free cash flow represents those amountsin each operating perlod that are "free"to be distributed to the wppliers of the firm's capital. 10 Current liabilities are shorteterm obligations of a company that are fixed by agreement. 11 When analysts value the current-fiability component of a complete business, they normally just read the value of the current liabilities from the firm's incomestat

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts