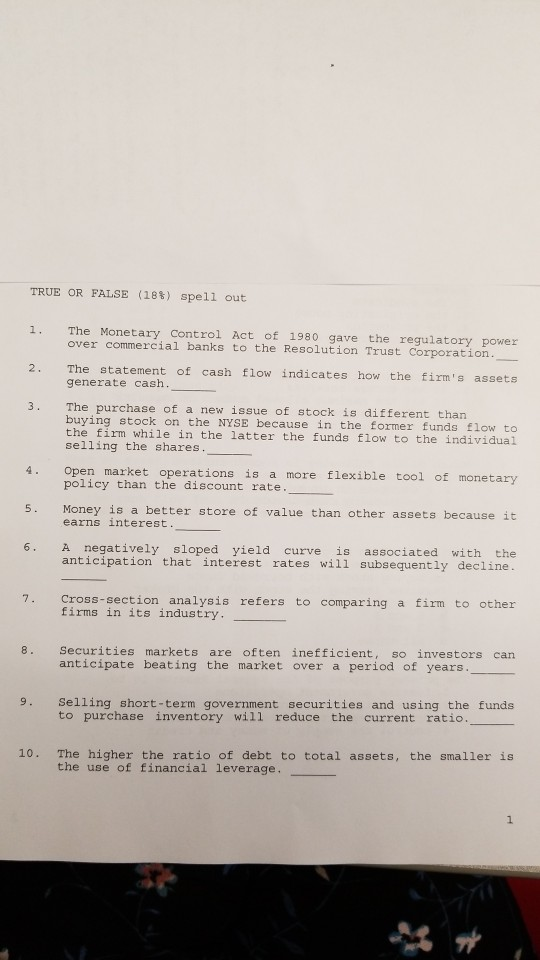

Question: TRUE OR FALSE (18%) spell out 1. The Monetary control Act of 1980 gave the regulatory power over commercial banks to the Resolution Trust Corporation

TRUE OR FALSE (18%) spell out 1. The Monetary control Act of 1980 gave the regulatory power over commercial banks to the Resolution Trust Corporation 2. The statement of cash flow indicates how the firm's assets generate cash. The purchase of a new iss buying stock on the NYSE because in the former funds flow to the firm whi le in the latter the funds flow to the individual 3. ue of stock is dic ferent than selling the shares. 4. Open market operations is a more flexible tool of monetary 5. Money is a better store of value than other assets because it 6. A negatively sloped yield curve is associated with the policy than the discount rate. earns interest anticipation that interest rates will subsequently decline. Cross-section analysis refers to comparing a firm to other firms in its industry 8. Securities markets are often inefficient, so investors can anticipate beating the market over a period of years 9. Selling short-term government securities and using the funds to purchase inventory will reduce the current ratio. 10. The higher the ratio of debt to total assets, the smaller is the use of financial leverage

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts