Question: True or False? 19. If you construct an optimal stock portfolio using the formula from this course, your true Sharpe ratio in the next year

True or False?

19. If you construct an optimal stock portfolio using the formula from this course, your true Sharpe ratio in the next year cannot be negative.

20. If you construct an optimal stock portfolio using the formula from this course, your sample Sharpe ratio in the next year cannot be negative.

21. If the stock price goes down and volatility goes up, the put option price should drop.

22. The portfolio theory is a probabilistic and statistical approach. It is fundamentally different from a security analysis that explores the fundamental values of individual stocks. Therefore, you should choose only one approach between two.

True or False?

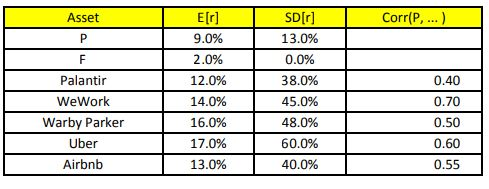

24. You are a fund manager who is managing Bauer High-Tech Fund. Your current portfolio is a mix of P and the riskfree asset is F. You analyze all available information and summarize it in the following table. The last column shows the correlation between P and a new stock. Suppose today Palantir, WeWork, Warby Parker, Uber, and Airbnb are available in the market because of their IPOs. Now your boss asks you to include only one stock among them in your portfolio to adjust the risky part of your portfolio. Also, your boss wants you to use only 5% of the value of the current risk part P of your whole portfolio to buy a new stock. For example, if you choose Uber, the new risky part of your portfolio weight will be (Uber, P) = (5%, 95%).

What stock should you include in your portfolio if you prefer high expected return and low volatility? Type the number only.

1) Palantir

2) WeWork

3) Warby Parker

4) Uber

5) Airbnb

6) None of them

Asset Corr(P, ...) P E[0] 9.0% 2.0% 12.0% 14.0% 16.0% Palantir WeWork Warby Parker Uber Airbnb SD[0] 13.0% 0.0% 38.0% 45.0% 48.0% 60.0% 40.0% 0.40 0.70 0.50 0.60 17.0% 13.0% 0.55 Asset Corr(P, ...) P E[0] 9.0% 2.0% 12.0% 14.0% 16.0% Palantir WeWork Warby Parker Uber Airbnb SD[0] 13.0% 0.0% 38.0% 45.0% 48.0% 60.0% 40.0% 0.40 0.70 0.50 0.60 17.0% 13.0% 0.55

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts