Question: True or False 20. Simple exponential smoothing is an appropriate method for prediction purposes when there is a significant trend present in a time series

True or False

20. Simple exponential smoothing is an appropriate method for prediction purposes when there is a significant trend present in a time series data.

21. The components of time series can be added or multiplied.

22. . Exponential smoothing is a forecasting method that applies equal weights to the time series observations.

23. Simple exponential forecasting method would not be used to forecast seasonal data.

24. Holt-Winter's double exponential smoothing would be an appropriate method to use to forecast a time series that exhibits a linear trend with no seasonal or cyclical patterns

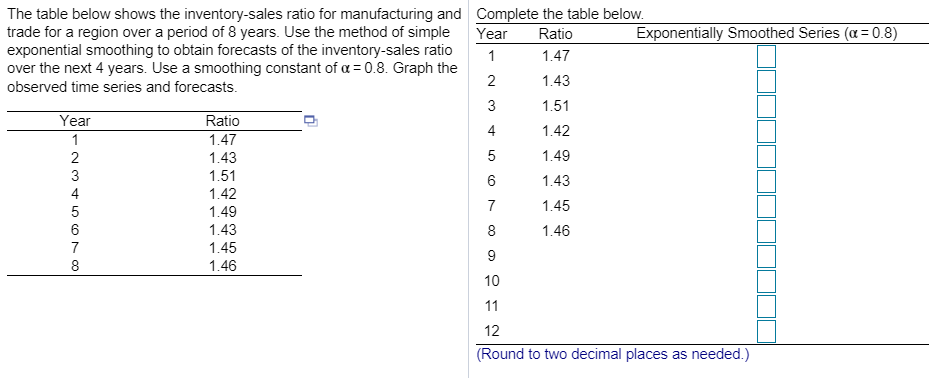

A conservatively financed firm would Multiple Choice O use long-term financing for all fixed assets and short-term financing for all other assets. O finance a portion of permanent assets and short-term assets with short-term debt. O use equity to finance fixed assets, use long-term debt to finance permanent assets, and use short-term debt to finance fluctuating current assets. O use long-term financing for three items: permanent current assets, fixed assets, and a portion of the short-term fluctuating assets. Then use short-term financing for all other short-term assets.The table belowr shows the inventory-sales ratio for manufacturing and Complete the table below. trade for a region over a period of 3 years. Use the method of simple Year Ratio Exponentially Smoothed Series [or =08) exponential smoothing to obtain forecasts of the inventorysales ratio over the next 4 years. Use a smoothing oonstant 0ft] 2 (1.3. Graph the 1 14? observed time series and forecasts. 2 1'43 = Y Rat D 3 1.51 ear Io . 1 1-4? 4 1.42 2 1.43 5 1.49 3 1-51 B 1.43 = 4 1.42 5 1.49 7 1.45 6 1.43 8 1.46 Y 1.45 g 8 1.46 1U 11 12 (Round to two decimal places as needed.)