Question: true or false 43. FUNDAMENTAL FORECASTING INVOLVES THE USE OF HISTORICAL EXCHANGE RATE DATA TO PREDICT FUTURE VALUES. 44. TECHNICAL FORECASTING IS CITED AS THE

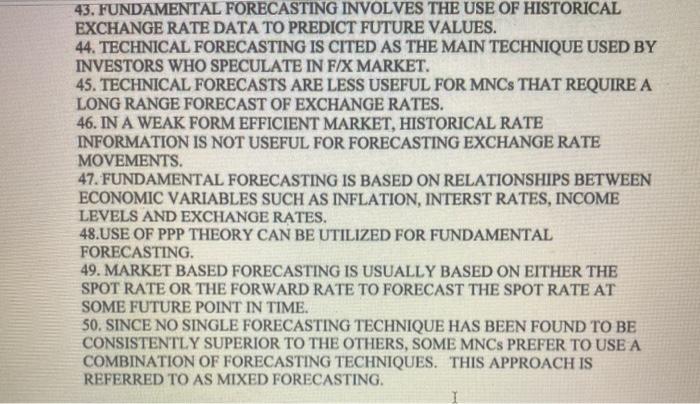

43. FUNDAMENTAL FORECASTING INVOLVES THE USE OF HISTORICAL EXCHANGE RATE DATA TO PREDICT FUTURE VALUES. 44. TECHNICAL FORECASTING IS CITED AS THE MAIN TECHNIQUE USED BY INVESTORS WHO SPECULATE IN F/X MARKET. 45. TECHNICAL FORECASTS ARE LESS USEFUL FOR MNCS THAT REQUIRE A LONG RANGE FORECAST OF EXCHANGE RATES. 46. IN A WEAK FORM EFFICIENT MARKET, HISTORICAL RATE INFORMATION IS NOT USEFUL FOR FORECASTING EXCHANGE RATE MOVEMENTS 47. FUNDAMENTAL FORECASTING IS BASED ON RELATIONSHIPS BETWEEN ECONOMIC VARIABLES SUCH AS INFLATION, INTERST RATES, INCOME LEVELS AND EXCHANGE RATES. 48.USE OF PPP THEORY CAN BE UTILIZED FOR FUNDAMENTAL FORECASTING. 49. MARKET BASED FORECASTING IS USUALLY BASED ON EITHER THE SPOT RATE OR THE FORWARD RATE TO FORECAST THE SPOT RATE AT SOME FUTURE POINT IN TIME. 50. SINCE NO SINGLE FORECASTING TECHNIQUE HAS BEEN FOUND TO BE CONSISTENTLY SUPERIOR TO THE OTHERS, SOME MNCs PREFER TO USE A COMBINATION OF FORECASTING TECHNIQUES. THIS APPROACH IS REFERRED TO AS MIXED FORECASTING

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts