Question: True or False (5 points each) 1. If their bond is held until maturity, an investor does not suffer losses due to interest rate risk.

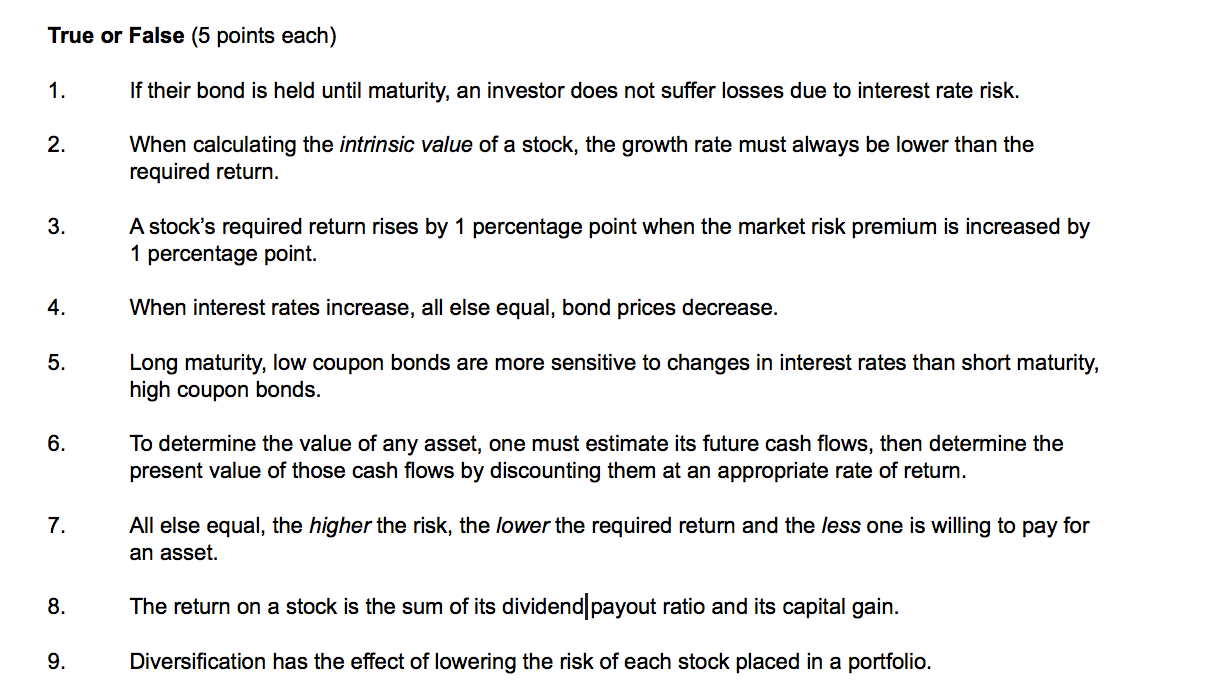

True or False (5 points each) 1. If their bond is held until maturity, an investor does not suffer losses due to interest rate risk. 2. When calculating the intrinsic value of a stock, the growth rate must always be lower than the required return. 3. A stock's required return rises by 1 percentage point when the market risk premium is increased by 1 percentage point. 4. When interest rates increase, all else equal, bond prices decrease. 5. Long maturity, low coupon bonds are more sensitive to changes in interest rates than short maturity, high coupon bonds. 6. To determine the value of any asset, one must estimate its future cash flows, then determine the present value of those cash flows by discounting them at an appropriate rate of return. 7. All else equal, the higher the risk, the lower the required return and the less one is willing to pay for an asset. 8. The return on a stock is the sum of its dividend payout ratio and its capital gain. 9. Diversification has the effect of lowering the risk of each stock placed in a portfolio

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts