Question: True or False A. A E 1 l l l 1 Colorful. List Porn Normal No Spact Heading 1 Sub Title Paragraph Shles 19. Both

True or False

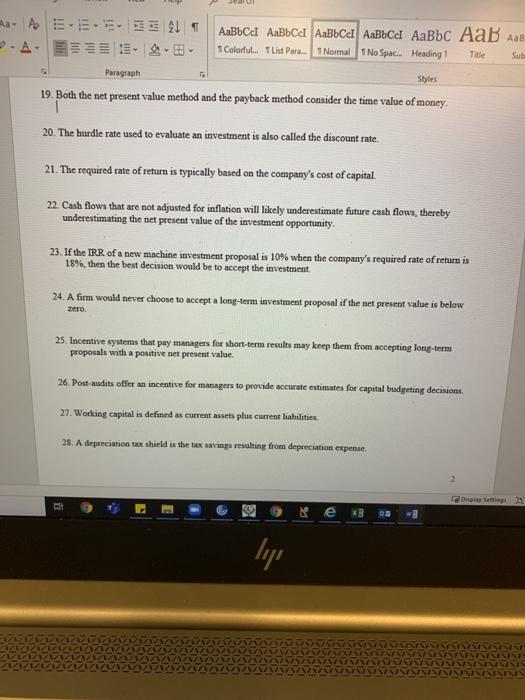

A. A E 1 l l l 1 Colorful. List Porn Normal No Spact Heading 1 Sub Title Paragraph Shles 19. Both the net present value method and the payback method consider the time value of money 20. The hurdle rate used to evaluate an investment is also called the discount rate. 21. The required rate of return is typically based on the company's cost of capital 22. Cash flows that are not adjusted for inflation will likely underestimate future cash flows, thereby underestimating the net present value of the investment opportunity. 23. If the IRR of a new machine investment proposal is 10% when the company's required rate of return is 18%, then the best decision would be to accept the investment 24. A firm would never choose to accept a long-term investment proposal if the net present value is below zero 25. Incentive systems that pay managers for short-term results may keep them from accepting long-term proposals with a positive net present value 26. Post-audits offer an incentive for managers to provide accurate estimates for capital badgeting decisions . 27. Working capital is defined as current assets plut current liabilities. 28. A depreciation tax thield is the tax savings resulting from depreciation expense. *3 ligi

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts