Question: True or False Answer if question is true or false 22. Taxpayers can simultaneously deduct as an itemized deduction the amount of their state and

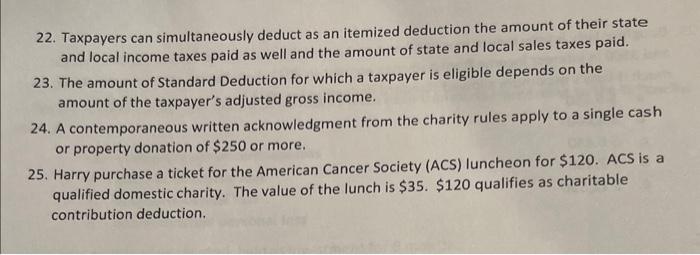

22. Taxpayers can simultaneously deduct as an itemized deduction the amount of their state and local income taxes paid as well and the amount of state and local sales taxes paid. 23. The amount of Standard Deduction for which a taxpayer is eligible depends on the amount of the taxpayer's adjusted gross income. 24. A contemporaneous written acknowledgment from the charity rules apply to a single cash or property donation of $250 or more. 25. Harry purchase a ticket for the American Cancer Society (ACS) luncheon for $120. ACS is a qualified domestic charity. The value of the lunch is $35. $120 qualifies as charitable contribution deduction

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts