Question: true or false Brief Exercise 127 State true or false for each of the following statements 1. The straight-line method of depreciation is based on

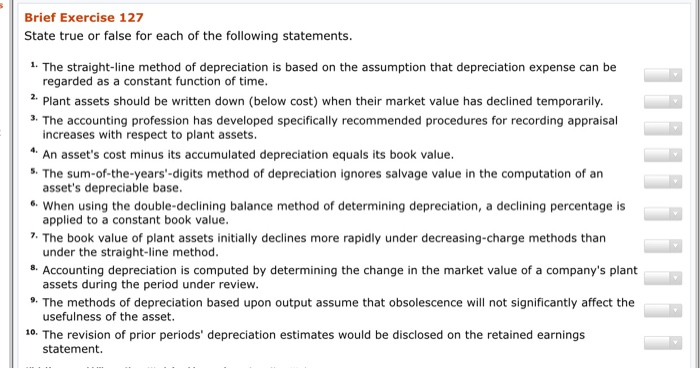

Brief Exercise 127 State true or false for each of the following statements 1. The straight-line method of depreciation is based on the assumption that depreciation expense can be regarded as a constant function of time 2. Plant assets should be written down (below cost) when their market value has declined temporarily 3. The accounting profession has developed specifically recommended procedures for recording appraisal increases with respect to plant assets 4. An asset's cost minus its accumulated depreciation equals its book value s. The sum-of-the-years'-digits method of depreciation ignores salvage value in the computation of an . When using the double-declining balance method of determining depreciation, a declining percentage is 7. The book value of plant assets initially declines more rapidly under decreasing-charge methods than 8. Accounting depreciation is computed by determining the change in the market value of a company's plant 9. The methods of depreciation based upon output assume that obsolescence will not significantly affect the 10. The revision of prior periods' depreciation estimates would be disclosed on the retained earnings asset's depreciable base applied to a constant book value under the straight-line method assets during the period under revievw usefulness of the asset statement

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts