Question: True or False. can i have help on 12 and 14. and can you check the other answers. Thank you! HW 12 4700 ce Mailings

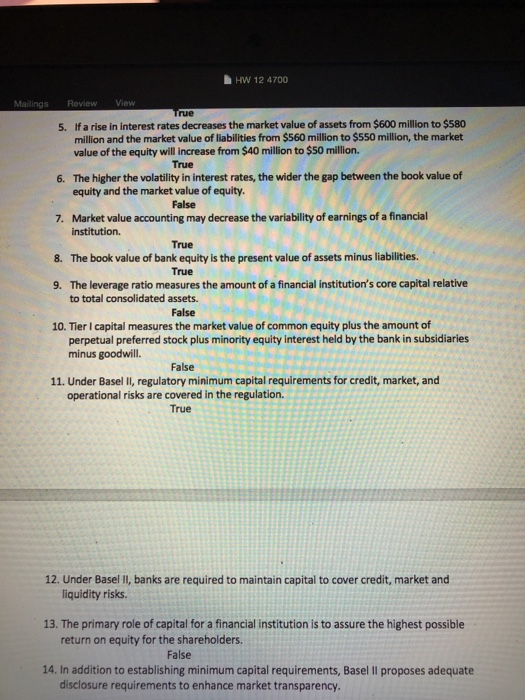

HW 12 4700 ce Mailings Review View True 5. If a rise in interest rates decreases the market value of assets from $600 million to $580 million and the market value of liabilities from $560 million to $550 million, the market value of the equity will increase from $40 million to $50 million. True 6. The higher the volatility in interest rates, the wider the gap between the book value of equity and the market value of equity. False 7. Market value accounting may decrease the variability of earnings of a financial institution True 8. The book value of bank equity is the present value of assets minus liabilities. True 9. The leverage ratio measures the amount of a financial institution's core capital relative to total consolidated assets. False 10. Tier I capital measures the market value of common equity plus the amount of perpetual preferred stock plus minority equity interest held by the bank in subsidiaries minus goodwill. False 11. Under Basel II, regulatory minimum capital requirements for credit, market, and operational risks are covered in the regulation. True ut of 12. Under Basel II, banks are required to maintain capital to cover credit, market and liquidity risks. 13. The primary role of capital for a financial institution is to assure the highest possible return on equity for the shareholders. False 14. In addition to establishing minimum capital requirements, Basel Il proposes adequate disclosure requirements to enhance market transparency

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts