Question: True or false for top. will thumbs up if done correct 70. In general, a drawer can stop payment of a certified or cashier's check.

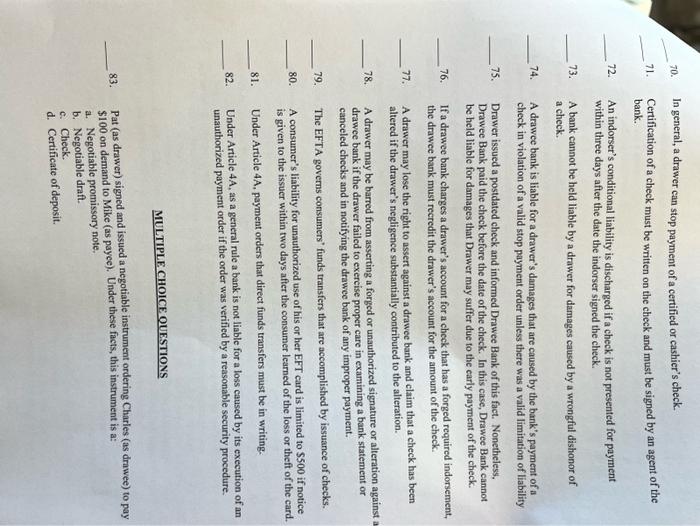

70. In general, a drawer can stop payment of a certified or cashier's check. 71. Certification of a check must be written on the check and must be signed by an agent of the bank. 72. An indorser's conditional liability is discharged if a check is not presented for payment within three days after the date the indorser signed the check. 73. A bank cannot be held liable by a drawer for damages caused by a wrongful dishonor of a check. 74. A drawee bank is liable for a drawer's damages that are caused by the bank's payment of a check in violation of a valid stop payment order unless there was a valid limitation of liability 75. Drawer issued a postdated check and informed Drawee Bank of this fact. Nonetheless, Drawee Bank paid the check before the date of the check. In this case, Drawee Bank cannot be held liable for damages that Drawer may suffer due to the carly payment of the check. 76. If a drawee bank charges a drawer's account for a check that has a forged required indorsement, the drawee bank must recredit the drawer's account for the amount of the check. 77. A drawer may lose the right to assert against a drawee bank and claim that a check has been altered if the drawer's negligence substantially contributed to the alteration. 78. A drawer may be barred from asserting a forged or unauthorized signature or alteration against a drawee bank if the drawer failed to exercise proper care in examining a bank statement or canceled checks and in notifying the drawee bank of any improper payment. 79. The EFTA governs consumers' funds transfers that are accomplished by issuance of checks. 80. A consumer's liability for unauthorized use of his or her EFT card is limited to $500 if notice is given to the issuer within two days after the consumer learned of the loss or theft of the card. 81. Under Article 4A, payment orders that direct funds transfers must be in writing. 82. Under Article 4A, as a general rule a bank is not liable for a loss caused by its execution of an unauthorized payment order if the order was verified by a reasonable security procedure. MULTIPLE CHOICE OUESTIONS 83. Pat (as drawer) signed and issued a negotiable instrument ordering Charies (as drawee) to pay $100 on demand to Mike (as payee). Under these facts, this instrument is a: a. Negotiable promissory note. b. Negotiable draft. c. Check. d. Certificate of deposit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts