Question: True or False, I will thumbs up the answer thanks QUESTION 5 Hartsfield International Airport in Atlanta, Georgia, is one of the busiest airports in

True or False, I will thumbs up the answer thanks

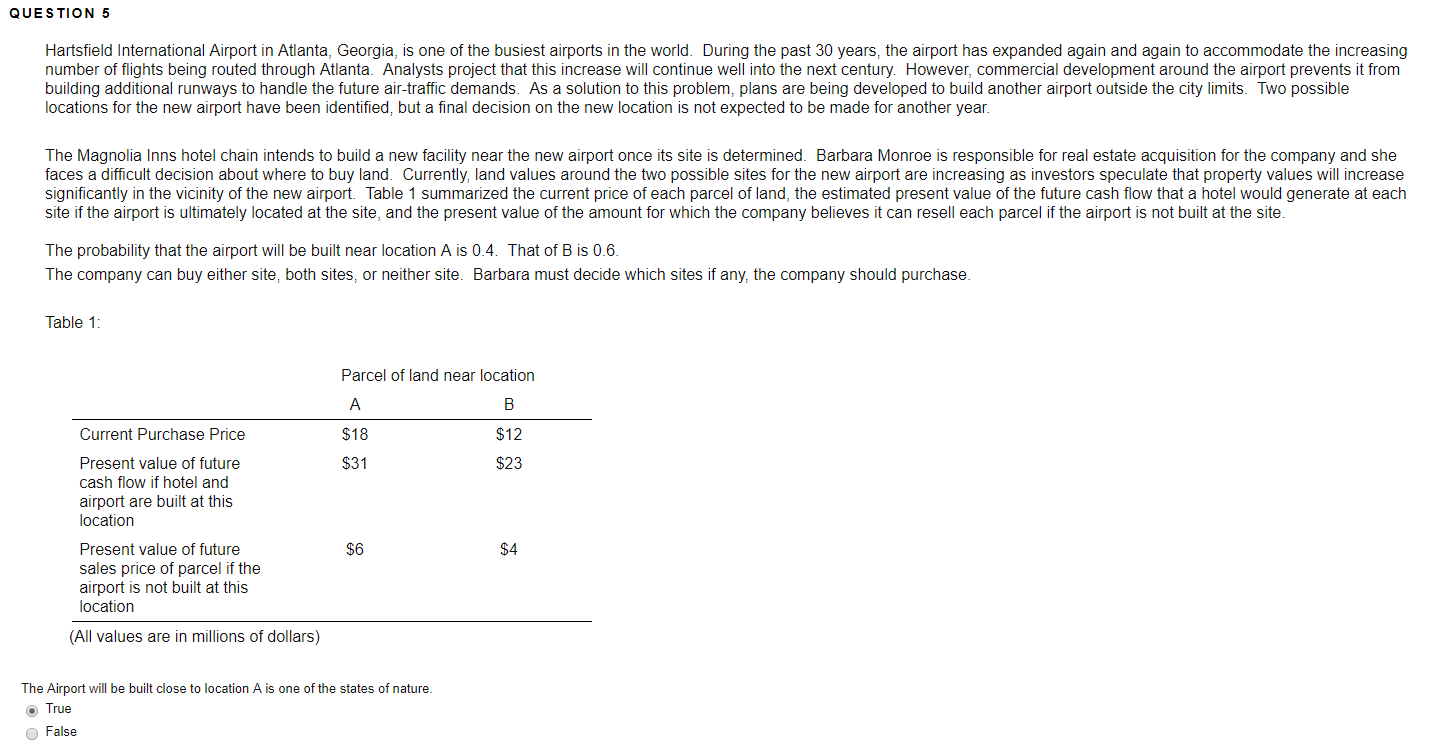

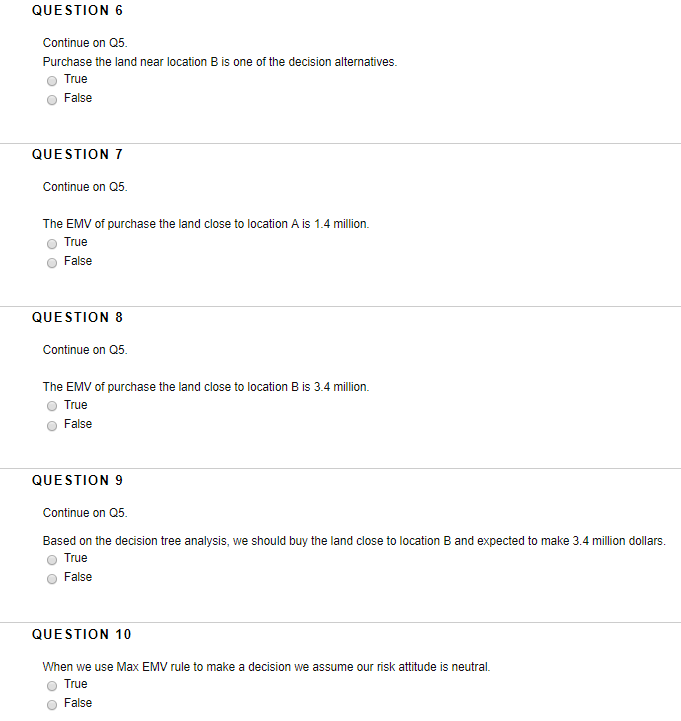

QUESTION 5 Hartsfield International Airport in Atlanta, Georgia, is one of the busiest airports in the world. During the past 30 years, the airport has expanded again and again to accommodate the increasing number of flights being routed through Atlanta Analysts project that this increase will continue well into the next century. However, commercial development around the airport prevents it from building additional runways to handle the future air-traffic demands. As a solution to this problem, plans are being developed to build another airport outside the city limits. Two possible locations for the new airport have been identified, but a final decision on the new location is not expected to be made for another year. The Magnolia Inns hotel chain intends to build a new facility near the new airport once its site is determined. Barbara Monroe is responsible for real estate acquisition for the company and she faces a difficult decision about where to buy land. Currently, land values around the two possible sites for the new airport are increasing as investors speculate that property values will increase significantly in the vicinity of the new airport. Table 1 summarized the current price of each parcel of land, the estimated present value of the future cash flow that a hotel would generate at each site if the airport is ultimately located at the site, and the present value of the amount for which the company believes it can resell each parcel if the airport is not built at the site The probability that the airport will be built near location A is 0.4. That of B is 0.6. The company can buy either site, both sites, or neither site. Barbara must decide which sites if any, the company should purchase. Table 1: Parcel of land near location $18 $31 $12 $23 Current Purchase Price Present value of future cash flow if hotel and airport are built at this location Present value of future sales price of parcel if the airport is not built at this location (All values are in millions of dollars) The Airport will be built close to location A is one of the states of nature. True False QUESTION 6 Continue on 05. Purchase the land near location B is one of the decision alternatives. True False QUESTION 7 Continue on 05. The EMV of purchase the land close to location A is 1.4 million. True False QUESTION 8 Continue on 05. The EMV of purchase the land close to location B is 3.4 million. True False QUESTION 9 Continue on 05 Based on the decision tree analysis, we should buy the land close to location B and expected to make 3.4 million dollars. True False QUESTION 10 When we use Max EMV rule to make a decision we assume our risk attitude is neutral. True False