Question: TRUE or FALSE: If the statement is FALSE, EXPLAIN why it is so. 21. Optional corpora penalty to the co income rather tha 22. For

TRUE or FALSE: If the statement is FALSE, EXPLAIN why it is so.

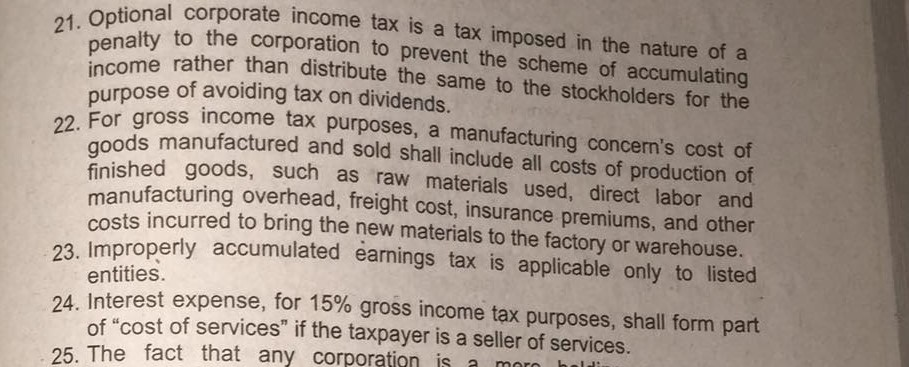

21. Optional corpora penalty to the co income rather tha 22. For gross income goods manufacture ods, such concer's cost of al corporate income tax is a tax imposed in the nature of a to the corporation to prevent the scheme of accumulating rather than distribute the same to the stockholders for the purpose of avoiding tax on dividends. aross income tax purposes, a manufacturing concern's cost of Is manufactured and sold shall include all costs of production of Spished goods, such as raw materials used. direct labor and manufacturing overhead, freight cost, insuran sts incurred to bring the new materials to the factory or warehouse. properly accumulated earnings tax is applicable only to listed entities. Interest expense, for 15% gross income tax purposes, shall form part of "cost of services" if the taxpayer is a seller of services. 25 The fact that any corporation is a morn hala as shall include all

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts