Question: TRUE or FALSE: If the statement is FALSE, EXPLAIN why it is so. 5. Associations and mutual fund companies, for income tax purposes are excluded

TRUE or FALSE: If the statement is FALSE, EXPLAIN why it is so.

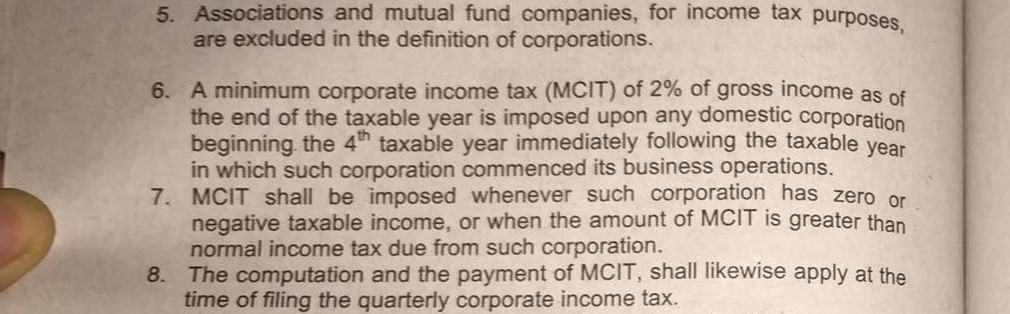

5. Associations and mutual fund companies, for income tax purposes are excluded in the definition of corporations. 6. A minimum corporate income tax (MCIT) of 2% of gross income as of the end of the taxable year is imposed upon any domestic corporation beginning the 4th taxable year immediately following the taxable year in which such corporation commenced its business operations. 7. MCIT shall be imposed whenever such corporation has zero or negative taxable income, or when the amount of MCIT is greater than normal income tax due from such corporation. 8. The computation and the payment of MCIT, shall likewise apply at the time of filing the quarterly corporate income tax

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts