Question: True or false Net working capital is the difference between current liabilities and current assets. Systematic risk is reduced through diversification. The IRR equates the

True or false

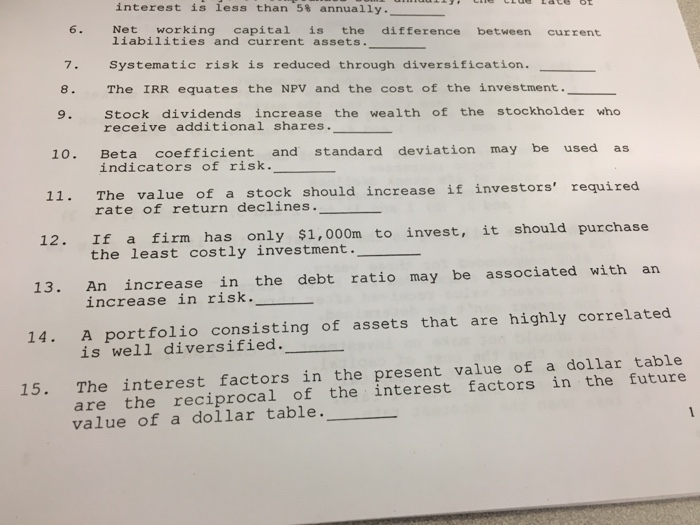

True or false Net working capital is the difference between current liabilities and current assets. Systematic risk is reduced through diversification. The IRR equates the NPV and the cost of the investment. Stock dividends increase the wealth of the stockholder who receive additional shares. Beta coefficient and standard deviation may be used as indicators of risk The value of a stock should increase if investors' required rate of return declines If a firm only $1,000m to invest, it should purchase has the least costly investment. An increase in the debt ratio may be associated with an increase in risk. A portfolio consisting of assets that are highly correlated is well diversified. The interest factors in the present value of a dollar table are the reciprocal of the interest factors in the future value of a dollar table

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts