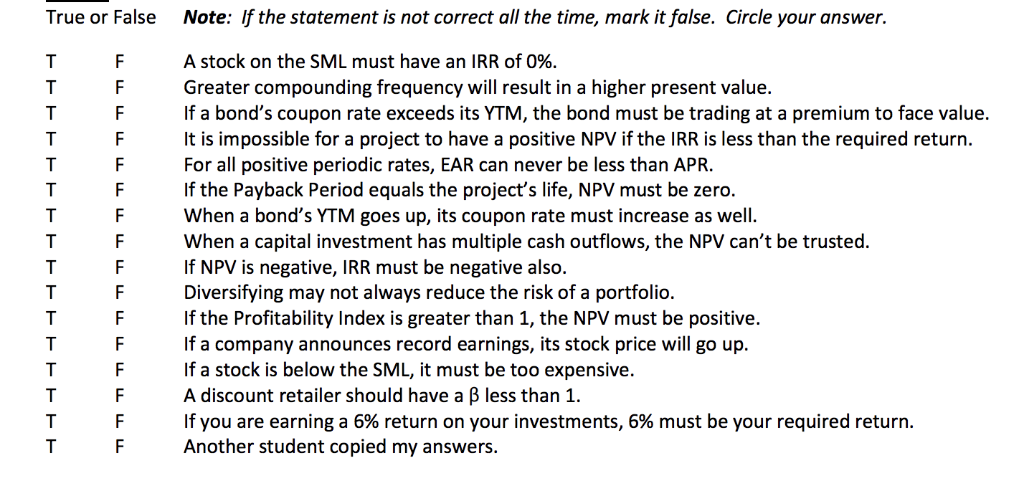

Question: True or False Note: If the statement is not correct all the time, mark it false. Circle your answer. A stock on the SML must

True or False Note: If the statement is not correct all the time, mark it false. Circle your answer. A stock on the SML must have an IRR of 096. Greater compounding frequency will result in a higher present value. If a bond's coupon rate exceeds its YTM, the bond must be trading at a premium to face value It is impossible for a project to have a positive NPV if the IRR is less than the required return. For all positive periodic rates, EAR can never be less than APR. If the Payback Period equals the project's life, NPV must be zero When a bond's YTM goes up, its coupon rate must increase as well. When a capital investment has multiple cash outflows, the NPV can't be trusted If NPV is negative, IRR must be negative also. Diversifying may not always reduce the risk of a portfolio If the Profitability Index is greater than 1, the NPV must be positive. If a company announces record earnings, its stock price will go up If a stock is below the SML, it must be too expensive. A discount retailer should have a less than 1. If you are earning a 6% return on your investments, 6% must be your required return. Another student copied my answers T F

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts