Question: true or false o O O O O 9. Over time U.S. equities occupy a larger percentage of the Global Capital Market 10. Transaction costs

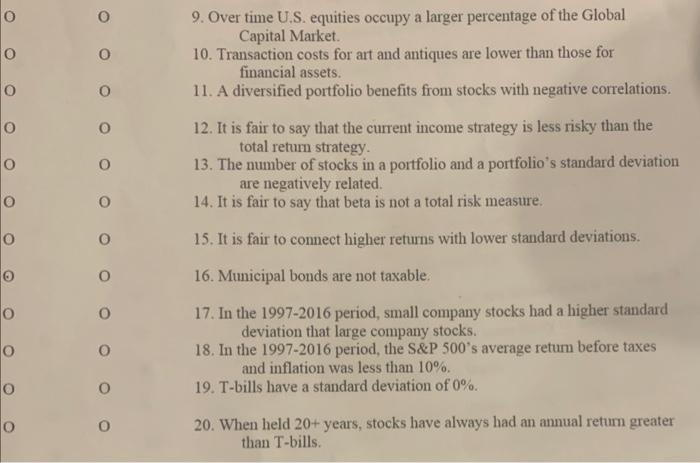

o O O O O 9. Over time U.S. equities occupy a larger percentage of the Global Capital Market 10. Transaction costs for art and antiques are lower than those for financial assets. 11. A diversified portfolio benefits from stocks with negative correlations. 12. It is fair to say that the current income strategy is less risky than the total return strategy 13. The number of stocks in a portfolio and a portfolio's standard deviation are negatively related 14. It is fair to say that beta is not a total risk measure. o o o o o o 15. It is fair to connect higher returns with lower standard deviations. o o 16. Municipal bonds are not taxable. o 0 17. In the 1997-2016 period, small company stocks had a higher standard deviation that large company stocks. 18. In the 1997-2016 period, the S&P 500's average retum before taxes and inflation was less than 10%. 19. T-bills have a standard deviation of 0%. o O O O 20. When held 20+ years, stocks have always had an annual return greater than T-bills

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts