Question: True or False (please answer all 3) Consider the (simplified) two-period model that we learned in chapter 8. At time 1, a household takes out

True or False (please answer all 3)

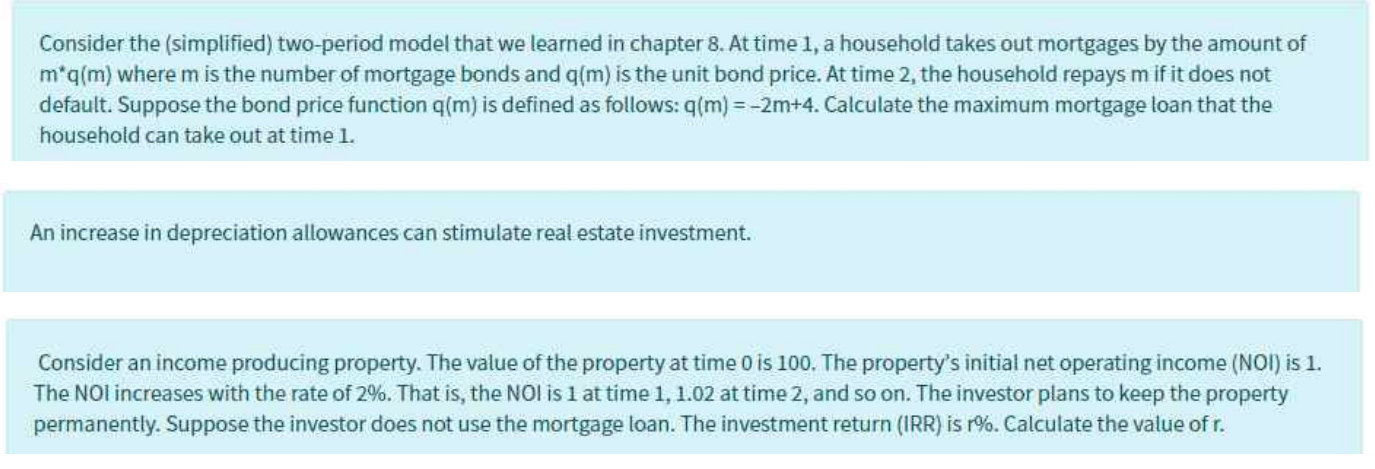

Consider the (simplified) two-period model that we learned in chapter 8. At time 1, a household takes out mortgages by the amount of m*q(m) where m is the number of mortgage bonds and q(m) is the unit bond price. At time 2, the household repays m if it does not default. Suppose the bond price function q(m) is defined as follows: q(m) = -2m+4. Calculate the maximum mortgage loan that the household can take out at time 1. An increase in depreciation allowances can stimulate real estate investment. Consider an income producing property. The value of the property at time 0 is 100. The property's initial net operating income (NOI) is 1. The NOI increases with the rate of 2%. That is, the NOI is 1 at time 1, 1.02 at time 2, and so on. The investor plans to keep the property permanently. Suppose the investor does not use the mortgage loan. The investment return (IRR) is r%. Calculate the value of r. Consider the (simplified) two-period model that we learned in chapter 8. At time 1, a household takes out mortgages by the amount of m*q(m) where m is the number of mortgage bonds and q(m) is the unit bond price. At time 2, the household repays m if it does not default. Suppose the bond price function q(m) is defined as follows: q(m) = -2m+4. Calculate the maximum mortgage loan that the household can take out at time 1. An increase in depreciation allowances can stimulate real estate investment. Consider an income producing property. The value of the property at time 0 is 100. The property's initial net operating income (NOI) is 1. The NOI increases with the rate of 2%. That is, the NOI is 1 at time 1, 1.02 at time 2, and so on. The investor plans to keep the property permanently. Suppose the investor does not use the mortgage loan. The investment return (IRR) is r%. Calculate the value of r

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts