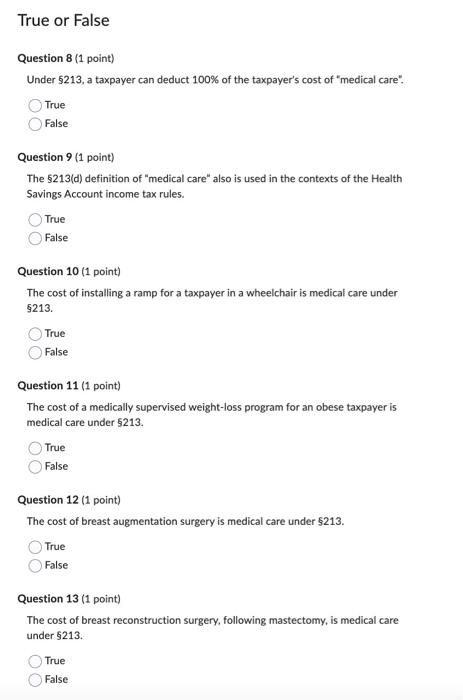

Question: True or False Question 8 (1 point) Under $213, a taxpayer can deduct 100% of the taxpayer's cost of medical care. True False Question 9

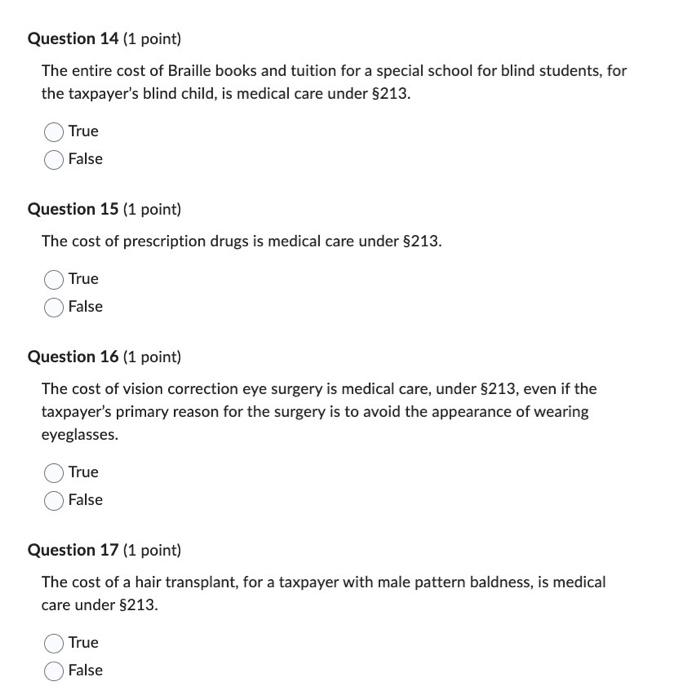

True or False Question 8 (1 point) Under $213, a taxpayer can deduct 100% of the taxpayer's cost of "medical care". True False Question 9 (1 point) The 5213 (d) definition of "medical care" also is used in the contexts of the Health Savings Account income tax rules. True False Question 10 (1 point) The cost of installing a ramp for a taxpayer in a wheelchair is medical care under 213. True False Question 11 (1 point) The cost of a medically supervised weight-loss program for an obese taxpayer is medical care under $213. True False Question 12 (1 point) The cost of breast augmentation surgery is medical care under $213. True False Question 13 (1 point) The cost of breast reconstruction surgery, following mastectomy, is medical care under $213. True False The entire cost of Braille books and tuition for a special school for blind students, for the taxpayer's blind child, is medical care under 213. True False Question 15 (1 point) The cost of prescription drugs is medical care under 213. True False Question 16 (1 point) The cost of vision correction eye surgery is medical care, under $213, even if the taxpayer's primary reason for the surgery is to avoid the appearance of wearing eyeglasses. True False Question 17 (1 point) The cost of a hair transplant, for a taxpayer with male pattern baldness, is medical care under 213. True False

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts