Question: True or false questions need help answering them correctly 9. The date on which taxes are due for the employer depends on the total amount

True or false questions need help answering them correctly

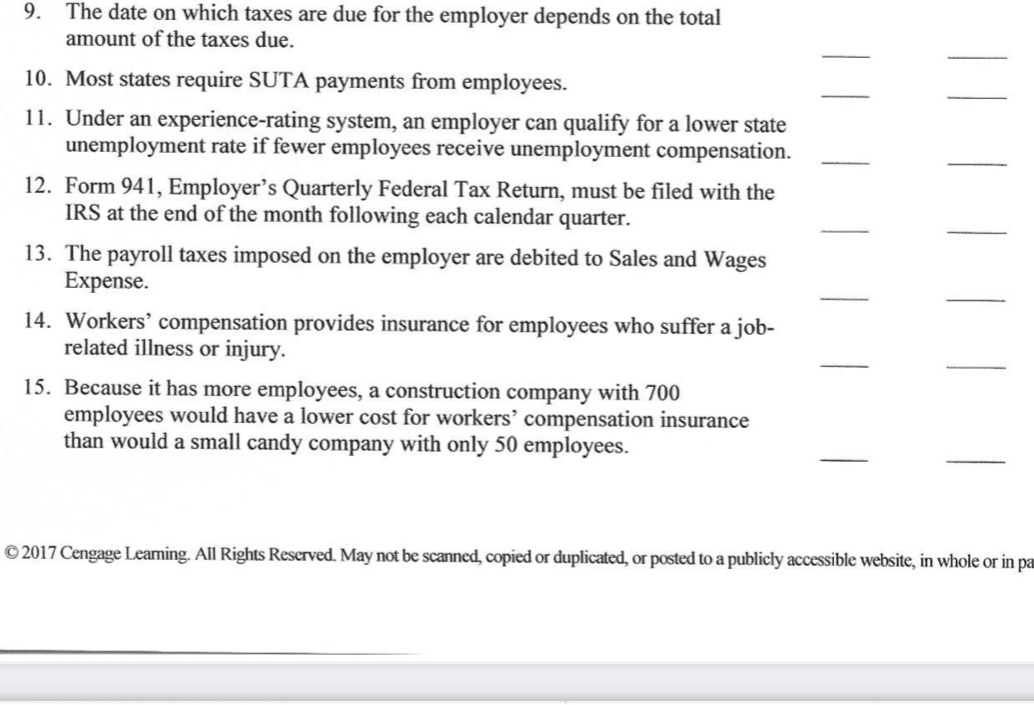

9. The date on which taxes are due for the employer depends on the total amount of the taxes due. 10. Most states require SUTA payments om employees. ll. Under an experience-rating system, an employer can qualify for a lower state unemployment rate if fewer employees receive unemployment compensation. 12. Form 94 l , Employer's Quarterly Federal Tax Return, must be led with the IRS at the end of the month following each calendar quarter. 13. The payroll taxes imposed on the employer are debited to Sales and Wages Expense. 14. Workers' compensation provides insurance for employees who suffer ajob- related illness or injury. 15. Because it has more employees, a construction company with 700 employees would have a lower cost for workers' compensation insurance than would a small candy company with only 50 employees. CZlKJuwb-JlagMMWWthWaWanaMWWhMUMm

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts