Question: True or False: ROE is increased with Debt levels. ROA rises with high levels of Intangible Assets. When companies have significant interest-bearing Noncurrent Liabilities, these

True or False:

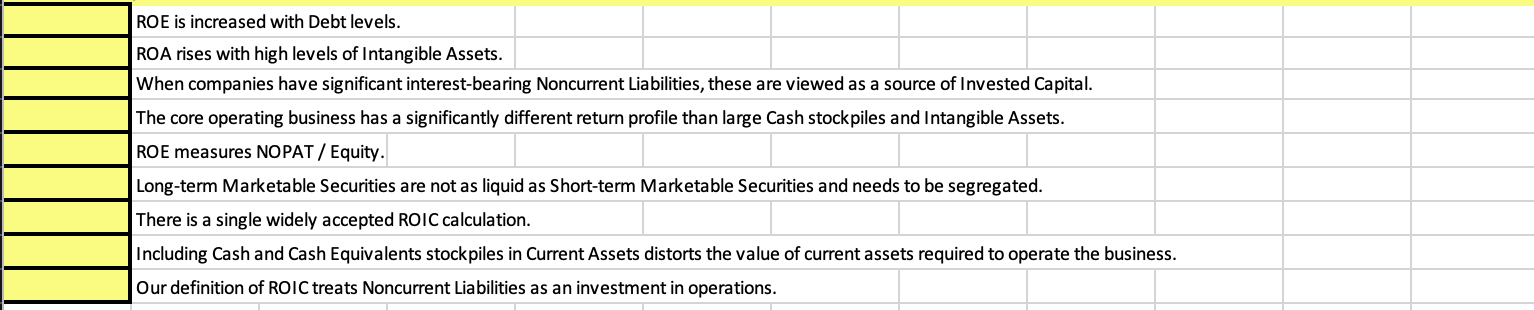

ROE is increased with Debt levels. ROA rises with high levels of Intangible Assets. When companies have significant interest-bearing Noncurrent Liabilities, these are viewed as a source of Invested Capital. The core operating business has a significantly different return profile than large Cash stockpiles and Intangible Assets. ROE measures NOPAT / Equity. Long-term Marketable Securities are not as liquid as Short-term Marketable Securities and needs to be segregated. There is a single widely accepted ROIC calculation. Including Cash and Cash Equivalents stockpiles in Current Assets distorts the value of current assets required to operate the business. Our definition of ROIC treats Noncurrent Liabilities as an investment in operations

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts