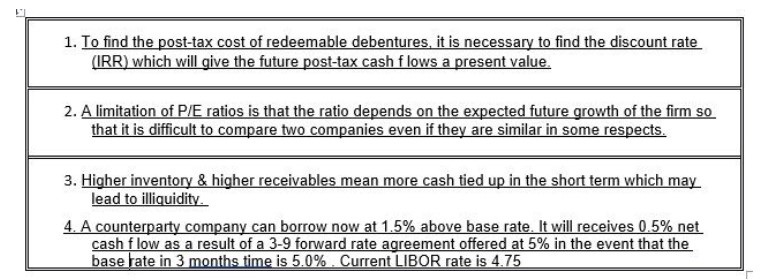

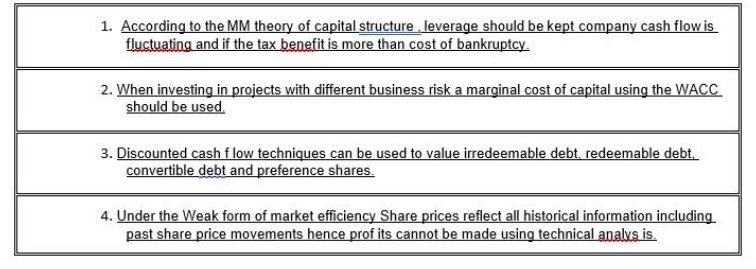

Question: TRUE OR FALSE? SET A. 1. To find the post-tax cost of redeemable debentures, it is necessary to find the discount rate (IRR) which will

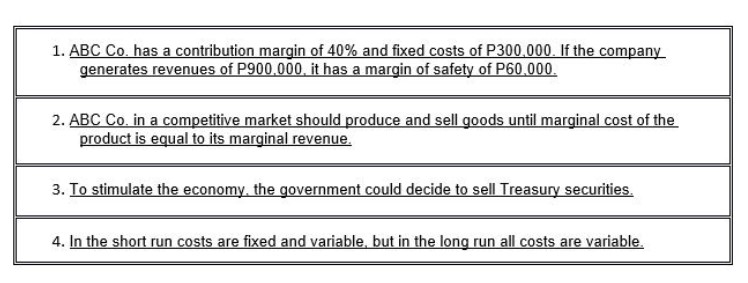

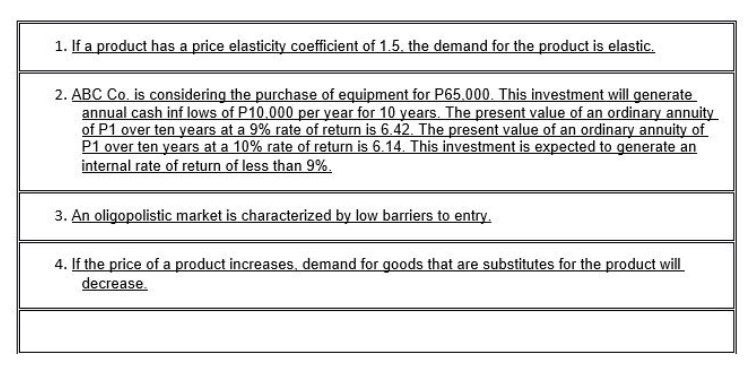

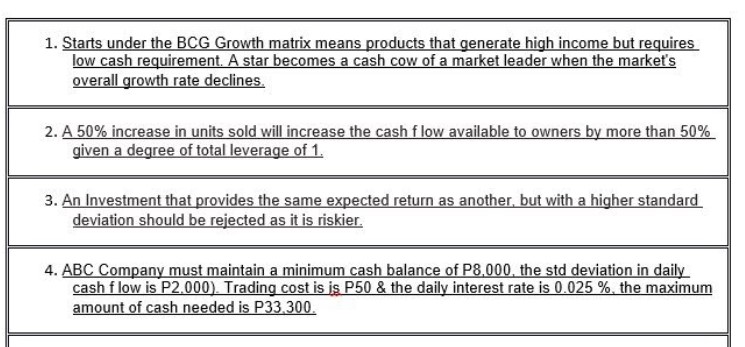

TRUE OR FALSE?

SET A.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock