Question: True or False True False O O 1. A declining market would favor the top-down approach over the bottom-up method. 2. In the constant growth

True or False

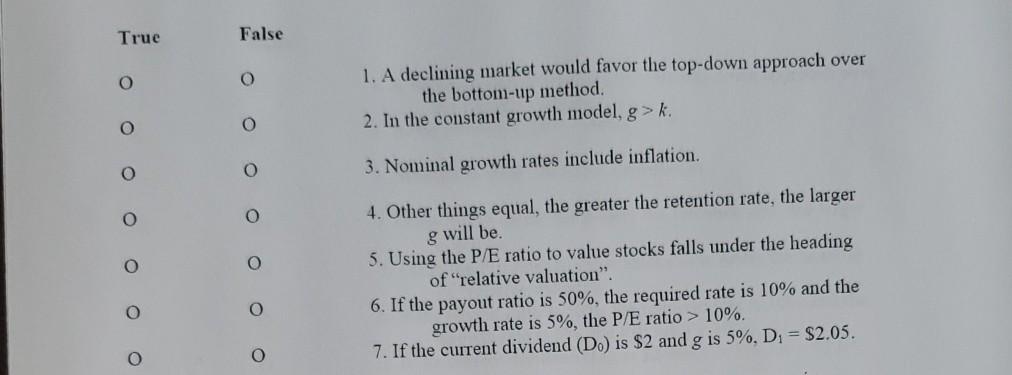

True False O O 1. A declining market would favor the top-down approach over the bottom-up method. 2. In the constant growth model, g>k. O O O O 3. Nominal growth rates include inflation. O O O O 4. Other things equal, the greater the retention rate, the larger g will be. 5. Using the P/E ratio to value stocks falls under the heading of "relative valuation". 6. If the payout ratio is 50%, the required rate is 10% and the growth rate is 5%, the P/E ratio > 10%. 7. If the current dividend (D) is $2 and g is 5%, D = $2.05. O O O

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts