Question: true or false True or False. If False Justify (If False, justify...) your answer in one sentence. A security with a negative beta should have

true or false

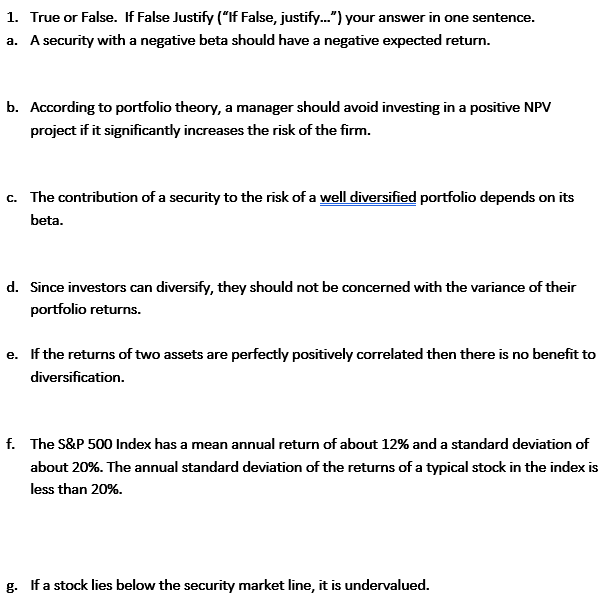

True or False. If False Justify ("If False, justify...") your answer in one sentence. A security with a negative beta should have a negative expected return. 1. a. According to portfolio theory, a manager should avoid investing in a positive NPV project if it significantly increases the risk of the firm. b. The contribution of a security to the risk of a well diversified portfolio depends on its beta c. d. Since investors can diversify, they should not be concerned with the variance of their portfolio returns. If the returns of two assets are perfectly positively correlated then there is no benefit to diversification. e. f. The S&P 500 Index has a mean annual return of about 12% and a standard deviation of about 20%. The annual standard deviation of the returns of a typical stock in the index is less than 20%. g. If a stock lies below the security market line, it is undervalued

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts