Question: True or false True or False? In both the Dividend Discount model (DDM) and the Free Cash Flow to Equity (FCFE) models, the rate of

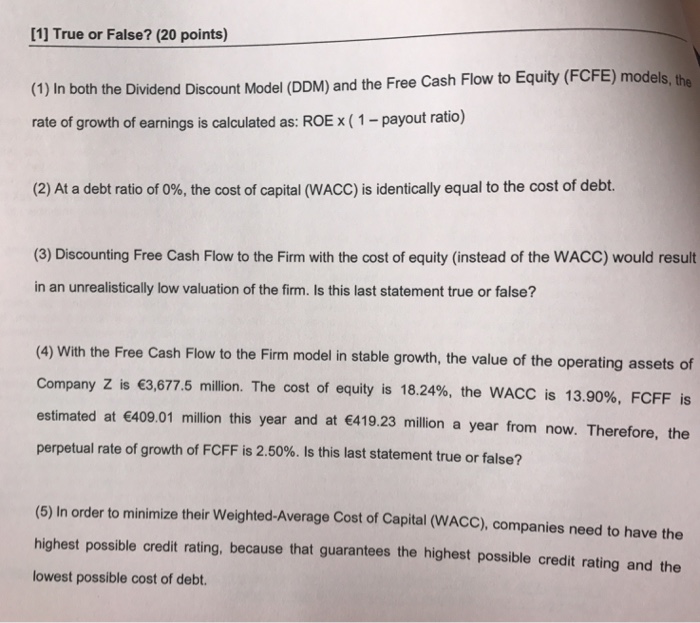

True or False? In both the Dividend Discount model (DDM) and the Free Cash Flow to Equity (FCFE) models, the rate of growth of earnings is calculated as: ROE x(1- payout ratio) At a debt ratio of 0 %, the cost of capital (WACC) is identically equal to the cost of debt. Discounting Free Cash Flow to the Firm with the cost of equity (instead of the WACC) would result in an unrealistically low valuation of the firm. Is this last statement true or false? With the Free Cash Flow to the Firm model in stable growth, the value of the operating assets of Company z is epsilon 3, 677.5 million. The cost of equity is 18.24%, the WACC is 13.90%, FCFF is estimated at epsilon 409.01 million this year and at epsilon 419.23 million a year from now. Therefore, the perpetual rate of growth of FCFF is 2.50%. Is this last statement true or false? In order to minimize their Weighted-Average Cost of Capital (WACC), companies need to have the highest possible credit rating, because that guarantees the highest possible credit rating and the lowest possible cost of debt

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts