Question: TRUE OR FALSE? When caculating how much value the possibility to expand the product sales will add to the pilot's product value, one can use

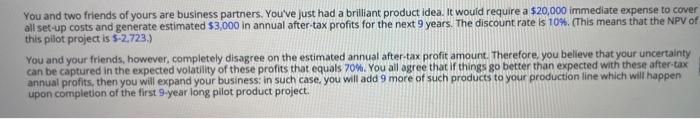

You and two friends of yours are business partners. You've just had a brilliant product idea. It would require a $20,000 immediate expense to cover all set-up costs and generate estimated $3,000 in annual after tax profits for the next 9 years. The discount rate is 10%. (This means that the NPV of this pilot project is 5-2,723.) You and your friends, however, completely disagree on the estimated annual after-tax profit amount. Therefore, you believe that your uncertainty can be captured in the expected volatility of these profits that equals 70%. You all agree that if things go better than expected with these after tax annual profits, then you will expand your business in such case, you will add 9 more of such products to your production line which will happen upon completion of the first 9 year long pilot product project. (a) TRUE OR FALSE? The higher the volatility (see given the more t's worth it to expand the pilot project in 9 years. (b) TRUE OR FALSE? When calculating how much value the possibility to expand the product sales will add to the pilot product's value, one can use the Black Scholes formula in this formula, the equivalent of the Strike will equal 10x520.000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts