Question: True or false. will thumbs up if given correct answers 51. In general, an indorser is anyone who signs an instrument in any capacity other

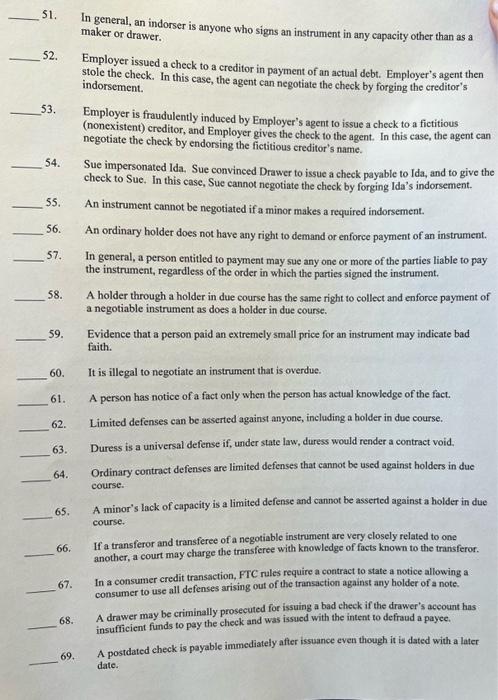

51. In general, an indorser is anyone who signs an instrument in any capacity other than as a maker or drawer. 52. Employer issued a check to a creditor in payment of an actual debt. Employer's agent then stole the check. In this case, the agent can negotiate the check by forging the creditor's indorsement. 53. Employer is fraudulently induced by Employer's agent to issue a check to a fictitious (nonexistent) creditor, and Employer gives the check to the agent. In this case, the agent can negotiate the check by endorsing the fictitious creditor's name. 54. Sue impersonated lda. Sue convinced Drawer to issue a check payable to Ida, and to give the check to Sue. In this case, Sue cannot negotiate the check by forging Ida's indorsement. 55. An instrument cannot be negotiated if a minor makes a required indorsement. 56. An ordinary holder does not have any right to demand or enforce payment of an instrument. 57. In general, a person entitled to payment may sue any one or more of the parties liable to pay the instrument, regardless of the order in which the parties signed the instrument. 58. A holder through a holder in due course has the same right to collect and enforce payment of a negotiable instrument as does a holder in due course. 59. Evidence that a person paid an extremely small price for an instrument may indicate bad faith. 60. It is illegal to negotiate an instrument that is overdue. 61. A person has notice of a fact only when the person has actual knowledge of the fact. 62. Limited defenses can be asserted against anyone, including a holder in due course. 63. Duress is a universal defense if, under state law, duress would render a contract void. 64. Ordinary contract defenses are limited defenses that cannot be used against holders in due course. 65. A minor's lack of capacity is a limited defense and cannot be asserted against a holder in due course. 66. If a transferor and transferee of a negotiable instrument are very closely related to one another, a court may charge the transferee with knowledge of facts known to the transferor. 67. In a consumer credit transaction, FTC rules require a contract to state a notice allowing a consumer to use all defenses arising out of the transaction against any holder of a note. 68. A drawer may be criminally prosecuted for issuing a bad check if the drawer's aceount has insufficient funds to pay the eheck and was issued with the intent to defraud a payee. 69. A postdated check is payable immediately after issuance even though it is dated with a later date

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts