Question: True or False (You can make assumptions to support your justification) In an efficient market, given a flat yield curve, all regular government bonds must

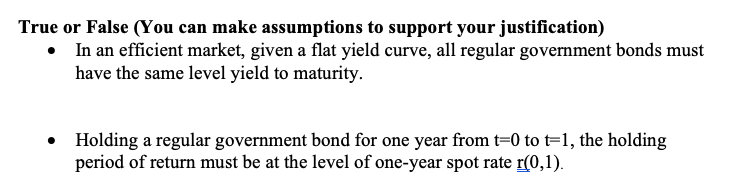

True or False (You can make assumptions to support your justification) In an efficient market, given a flat yield curve, all regular government bonds must have the same level yield to maturity. Holding a regular government bond for one year from t=0 to t=1, the holding period of return must be at the level of one-year spot rate r(0,1). True or False (You can make assumptions to support your justification) In an efficient market, given a flat yield curve, all regular government bonds must have the same level yield to maturity. Holding a regular government bond for one year from t=0 to t=1, the holding period of return must be at the level of one-year spot rate r(0,1)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts