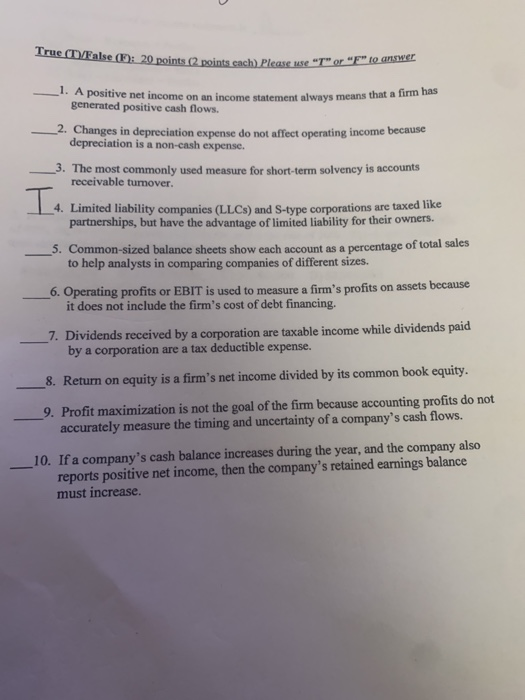

Question: True (T)/False (1): 20 points (2 points cach) Please use T or F to answer -3. 1. A positive net income on an income statement

True (T)/False (1): 20 points (2 points cach) Please use "T" or "F" to answer -3. 1. A positive net income on an income statement always means that a firm has generated positive cash flows. _2. Changes in depreciation expense do not affect operating income because depreciation is a non-cash expense. _3. The most commonly used measure for short-term solvency is accounts receivable turnover. It Limited liability companies (LLCs) and S-type corporations are taxed like partnerships, but have the advantage of limited liability for their owners. 5. Common-sized balance sheets show each account as a percentage of total sales to help analysts in comparing companies of different sizes. 6. Operating profits or EBIT is used to measure a firm's profits on assets because it does not include the firm's cost of debt financing. _7. Dividends received by a corporation are taxable income while dividends paid by a corporation are a tax deductible expense. 8. Return on equity is a firm's net income divided by its common book equity. 9. Profit maximization is not the goal of the firm because accounting profits do not accurately measure the timing and uncertainty of a company's cash flows. 10. If a company's cash balance increases during the year, and the company also reports positive net income, then the company's retained earnings balance must increase

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts