Question: True/False 1. A current liability to the state arises when a business sells an item and collects a state sales tax on it. True False

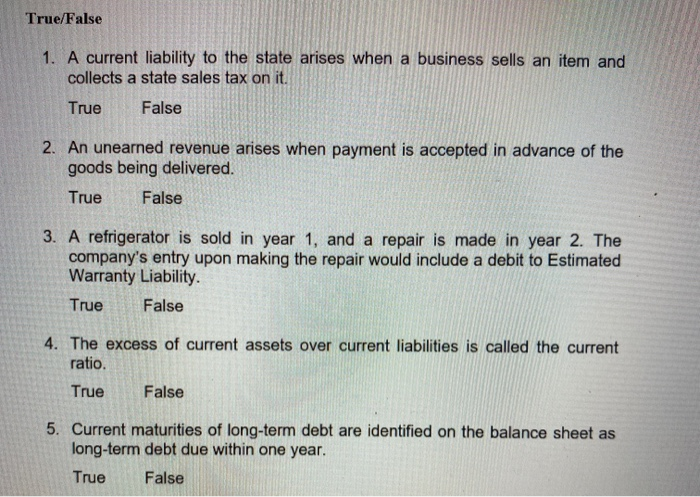

True/False 1. A current liability to the state arises when a business sells an item and collects a state sales tax on it. True False 2. An unearned revenue arises when payment is accepted in advance of the goods being delivered. True False 3. A refrigerator is sold in year 1, and a repair is made in year 2. The company's entry upon making the repair would include a debit to Estimated Warranty Liability. True False 4. The excess of current assets over current liabilities is called the current ratio. True False 5. Current maturities of long-term debt are identified on the balance sheet as long-term debt due within one year. True False

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts